DEF 14A: Definitive proxy statements

Published on November 25, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a‑101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a‑12

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

November 25, 2025 |  | ||||||||||

To Our Stockholders:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of PACS Group, Inc. at 11:00 a.m. Mountain time on Friday, December 19, 2025. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” on page 3 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet or by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. Instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

/s/ Jason Murray

Jason Murray

Co-Founder, Chief Executive Officer and Chairman

/s/ Mark Hancock

Mark Hancock

Co-Founder, Executive Vice Chairman and Interim Chief Financial Officer

PACS GROUP, INC. | 262 N. University Ave. | Farmington, Utah 84025 | ||||||||

Notice of Annual Meeting of Stockholders

To Be Held Friday, December 19, 2025

| |||||||||||||||||

The 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of PACS Group, Inc., a Delaware corporation (the “Company”), will be held at 11:00 a.m. Mountain time on Friday, December 19, 2025. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/PACS2025 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes: | |||||||||||||||||

DATE Friday, December 19, 2025 TIME 11:00 a.m. Mountain time RECORD DATE November 10, 2025 LOCATION Virtual meeting via webcast at www.virtualshareholdermeeting.com/PACS2025 | |||||||||||||||||

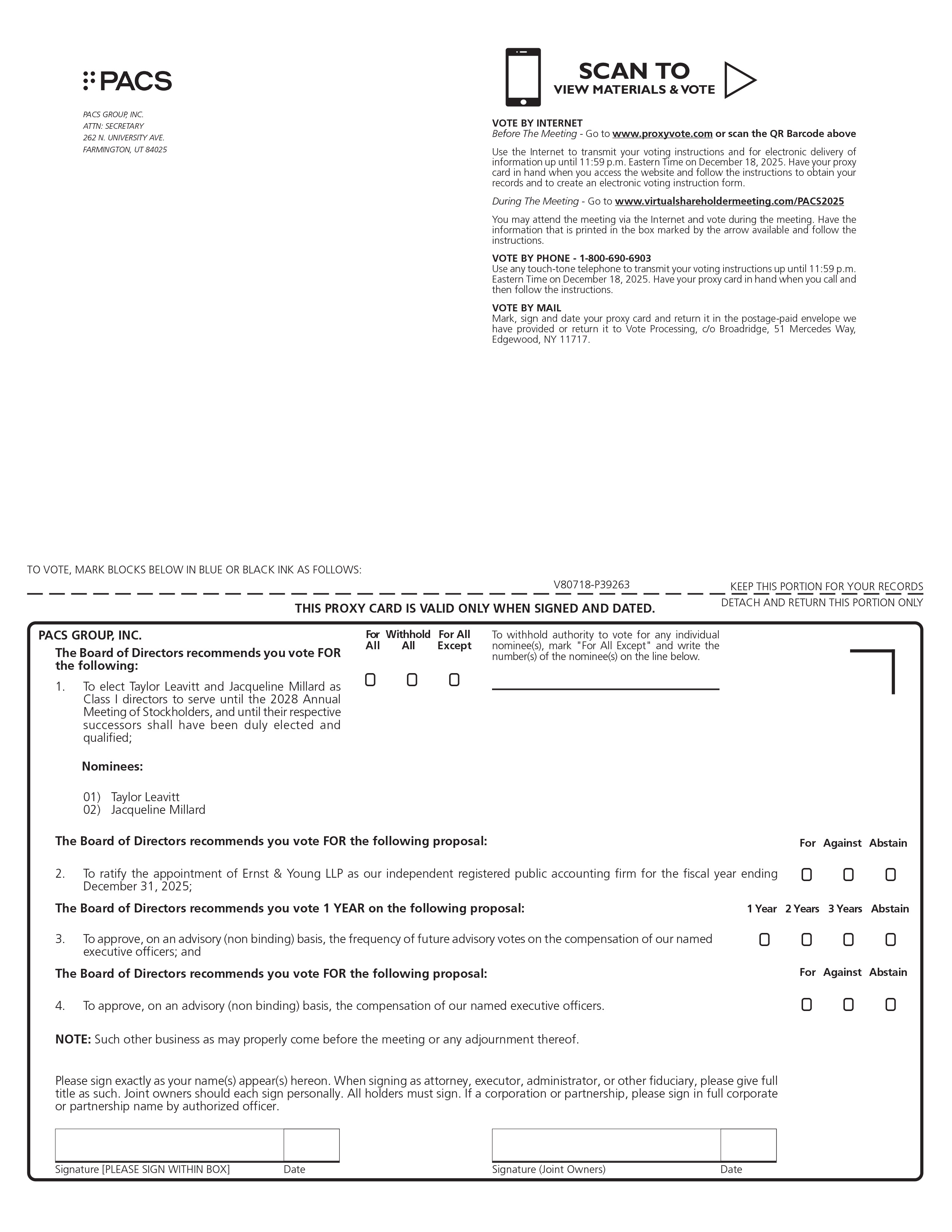

| To elect Taylor Leavitt and Jacqueline Millard as Class I directors to serve until the 2028 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified; | ||||||||||||||||

| To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025; | ||||||||||||||||

| To approve, on an advisory (non-binding) basis, the frequency of future advisory votes on the compensation of our named executive officers; | ||||||||||||||||

| To approve, on an advisory (non-binding) basis, the compensation of our named executive officers; and | ||||||||||||||||

| To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting. | ||||||||||||||||

Holders of record of our common stock as of the close of business on November 10, 2025 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to the Secretary, at IR@pacs.com, stating the purpose of the request and providing proof of ownership of Company stock. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting. | |||||||||||||||||

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a printed copy of your proxy card by mail, you may alternatively sign, date, and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

| ||||||||||||||

| Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. | ||||||||||||||

By Order of the Board of Directors

/s/ Jason Murray

Jason Murray

Co-Founder, Chief Executive Officer and Chairman

November 25, 2025

Table of Contents

Proxy Statement

This proxy statement is furnished in connection with the solicitation by the Board of Directors of PACS Group, Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday, December 19, 2025 (the “Annual Meeting”), at 11:00 a.m. Mountain time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/PACS2025 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of shares of our common stock, $0.001 par value per share as of the close of business on November 10, 2025 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, there were 156,615,444 shares of common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting. The holders of common stock will vote together as a single class on all matters to be presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2024 (the “2024 Annual Report”) will be released on or about November 25, 2025 to our stockholders on the Record Date.

In this proxy statement, “PACS”, “Company”, “we”, “us”, and “our” refer to PACS Group, Inc.

| ||||||||||||||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Friday December 19, 2025 | ||||||||||||||

This proxy statement and the 2024 Annual Report are available at http://www.proxyvote.com

General Information

PROPOSALS

At the Annual Meeting, our stockholders will be asked:

•To elect Taylor Leavitt and Jacqueline Millard as directors to serve until the 2028 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025;

•To approve, on an advisory (non-binding) basis, the frequency of future advisory votes on the compensation of our named executive officers;

•To approve, on an advisory (non-binding) basis, the compensation of our named executive officers; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

PACS 2025 Proxy Statement | 1 | |||||

| Proxy Statement | ||||||||

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

RECOMMENDATIONS OF THE BOARD OF DIRECTORS

The Company’s board of directors (the “Board of Directors” or the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted, and the Board of Directors recommends that you vote:

•FOR the election of Taylor Leavitt and Jacqueline Millard as directors to serve until the 2028 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025;

•ONE YEAR as the frequency of future advisory votes on the compensation of our named executive officers; and

•FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers.

INFORMATION ABOUT THIS PROXY STATEMENT

Why You Received This Proxy Statement. You are viewing or have received these proxy materials because PACS’s Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares. Instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at 1‑866‑540‑7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

2 | PACS 2025 Proxy Statement | |||||

| Proxy Statement | ||||||||

Questions and Answers About the 2025 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is November 10, 2025. You are entitled to vote at the Annual Meeting only if you were a holder of record of common stock at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of common stock is entitled to one vote on all matters presented at the Annual Meeting. At the close of business on the Record Date, there were 156,615,444 shares of common stock outstanding and entitled to vote at the Annual Meeting.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares online at the Annual Meeting unless you obtain a legal proxy from your bank or brokerage firm.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting online, or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

PACS has decided to hold the Annual Meeting entirely online this year. You may attend the Annual Meeting online only if you are a PACS stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. You may attend and participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/PACS2025. To attend and participate in the Annual Meeting, you will need the 16‑digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16‑digit control number or otherwise vote through the bank or broker. If you lose your 16‑digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 11:00 a.m. Mountain time. We encourage you to access the meeting prior to the start time. Online check‑in will begin at 10:45 p.m. Mountain time, and you should allow ample time for the check‑in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting is authorized by our Amended and Restated Bylaws to adjourn the meeting, without the vote of stockholders. In addition, in the absence of a quorum, if the Board of Directors so determines, the stockholders may adjourn the meeting by the affirmative vote of a majority of the voting power present in person or represented by proxy of the outstanding shares of common stock entitled to vote thereon.

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the Internet, or, by signing, dating, and returning the enclosed proxy card in the enclosed envelope.

PACS 2025 Proxy Statement | 3 | |||||

| Proxy Statement | ||||||||

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet‑You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card;

•by Telephone‑You can vote by telephone by calling 1‑800‑690‑6903 and following the instructions on the proxy card;

•by Mail‑You can vote by mail by signing, dating, and mailing the printed proxy card, which you may have received by mail; or

•Electronically at the Meeting‑If you attend the meeting online, you will need the 16‑digit control number included on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern time, on December 18, 2025. To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 16‑digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16‑digit control number or otherwise vote through the bank or broker. If you lose your 16‑digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of PACS prior to the Annual Meeting; or

•by voting online at the Annual Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting by obtaining your 16‑digit control number or otherwise voting through the bank or broker.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

4 | PACS 2025 Proxy Statement | |||||

| Proxy Statement | ||||||||

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. The Board of Directors’ recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

A virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/PACS2025. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located on www.virtualshareholdermeeting.com/PACS2025.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during the meeting that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than as a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

•irrelevant to the business of the Company or to the business of the Annual Meeting;

•related to material non public information of the Company, including the status or results of our business since our most recent periodic report filed with the SEC;

•related to any pending, threatened or ongoing litigation;

•related to personal grievances;

•derogatory references to individuals or that are otherwise in bad taste;

•substantially repetitious of questions already made by another stockholder;

•in excess of the two question limit;

•in furtherance of the stockholder’s personal or business interests; or

•out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in his or her reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than as a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?”.

PACS 2025 Proxy Statement | 5 | |||||

| Proxy Statement | ||||||||

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non‑votes be treated?

| PROPOSAL | VOTES REQUIRED | EFFECT OF VOTES WITHHELD / ABSTENTIONS AND BROKER NON-VOTES | ||||||||||||||||||

Proposal 1: Election of Directors | The plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. | Votes withheld and broker non-votes will have no effect. | ||||||||||||||||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes). | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. | ||||||||||||||||||

Proposal 3: Approval, on an Advisory (Non-Binding) Basis of the Frequency of Future Advisory Votes on the Compensation of our Named Executive Officers | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes). If no frequency receives the foregoing vote, then we will consider the option of ONE YEAR, TWO YEARS, or THREE YEARS that receives the highest number of votes cast to be the frequency recommended by stockholders. | Abstentions and broker non-votes will have no effect. | ||||||||||||||||||

Proposal 4: Approval, on an Advisory (Non-Binding) Basis, of the Compensation of our Named Executive Officers | The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes). | Abstentions and broker non-votes will have no effect. | ||||||||||||||||||

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the cases of the proposals regarding the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, the approval, on an advisory (non-binding) basis of the frequency of future advisory votes on the compensation of our named executive officers, and the approval, on an advisory (non‑binding) basis, of the compensation of our named executive officers, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum.

Votes withheld have no effect on the election of directors. Abstentions have no effect on the ratification of the appointment of Ernst & Young LLP, the approval, on an advisory (non-binding) basis of the frequency of future advisory votes on the compensation of our named executive officers, or the approval, on an advisory (non‑binding) basis, of the compensation of our named executive officers.

What are broker non‑votes and do they count for determining a quorum?

Generally, broker non‑votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner, and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such

6 | PACS 2025 Proxy Statement | |||||

| Proxy Statement | ||||||||

shares, a broker is not entitled to vote shares held for a beneficial owner on non‑routine matters, such as the election of directors, the approval, on an advisory (non-binding) basis of the frequency of future advisory votes on the compensation of our named executive officers, and the approval, on an advisory (non‑binding) basis, of the compensation of our named executive officers. Broker non‑votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8‑K, which we intend to file with the SEC after the Annual Meeting.

PACS 2025 Proxy Statement | 7 | |||||

Proposals to Be Voted On

Proposal 1: Election of Directors

We currently have five directors on our Board of Directors. At the Annual Meeting, two Class I directors, Taylor Leavitt and Jacqueline Millard, are to be elected to hold office until the annual meeting of stockholders to be held in 2028 and until each such director’s respective successor is duly elected and qualified or until each such director’s earlier death, resignation or removal.

As set forth in our Amended and Restated Charter, the Board is currently divided into three classes with staggered, three‑year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose current term will expire at the upcoming Annual Meeting and, if elected, whose subsequent term will expire at the 2028 annual meeting of stockholders; Class II, whose current term will expire at the 2026 annual meeting of stockholders; and Class III, whose current term will expire at the 2027 annual meeting of stockholders. The current Class I Directors are Taylor Leavitt and Jacqueline Millard; the current Class II Directors are Evelyn Dilsaver and Mark Hancock; and the current Class III Director is Jason Murray.

In addition, our Amended and Restated Charter provides for the removal of any of our directors at any time with or without cause by the affirmative vote of the holders of a majority of the voting power of the then outstanding shares of our voting stock entitled to vote thereon; provided, however, that at any time when Messrs. Murray and Hancock beneficially own, in the aggregate, less than the majority of the voting power of our outstanding shares of voting stock, directors may be removed only for cause and only by the affirmative vote of the holders of at least 66 2/3% of the voting power of the then outstanding shares of our voting stock entitled to vote thereon. As a result, for so long as Messrs. Murray and Hancock own, in the aggregate, more than a majority of the voting power of our outstanding shares of our voting stock, they will be able to remove any of our directors at any time with or without cause.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as directors of the persons whose names and biographies appear below. In the event that any of Taylor Leavitt and Jacqueline Millard should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board of Directors or the Board may elect to reduce its size. The Board of Directors has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the director nominees has consented to being named in this proxy statement and to serve if elected.

VOTE REQUIRED

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board unanimously recommends a vote FOR the election of each of the below Class I Director nominees.

8 | PACS 2025 Proxy Statement | |||||

| Proposals to Be Voted On | ||||||||

Nominees for Class I Director (upon election at the upcoming Annual Meeting, terms to expire at the 2028 Annual Meeting of Stockholders)

The current members of the Board who are also nominees for election to the Board as Class I Directors are as follows:

| NAME | AGE | POSITION WITH PACS | ||||||||||||

| Taylor Leavitt | 48 | Director | ||||||||||||

| Jacqueline Millard | 64 | Director | ||||||||||||

The principal occupations and business experience, for at least the past five years, of each Class I Director nominee for election at the upcoming Annual Meeting are as follows:

|  Taylor Leavitt EXPERIENCE Taylor Leavitt has served as a member of our board of directors since July 2023. Mr. Leavitt owns and has served as the Chief Executive Officer and Managing Partner of Leavitt Equity Partners, a healthcare‑focused private equity firm, since August 2014. Mr. Leavitt currently serves on the board of directors of several private entities that provide healthcare services. BACKGROUND Previously, Mr. Leavitt was a co‑founder and Partner of Leavitt Partners, a healthcare strategy consulting firm, from June 2009 to December 2020. Mr. Leavitt received a B.S. in Finance and Economics from Utah State University and a Master of Business Administration from the UCLA Anderson School of Management. We believe Mr. Leavitt is qualified to serve on our board of directors because of his strong business acumen and extensive experience in finance and investing. | |||||||||||||

| Director | ||||||||||||||

PACS 2025 Proxy Statement | 9 | |||||

| Proposals to Be Voted On | ||||||||

|  Jacqueline Millard EXPERIENCE Jacqueline Millard has served as a member of our board of directors since July 2023. Since January 2021, Ms. Millard has owned and operated a private investment advisory firm. BACKGROUND Previously, Ms. Millard was the Vice President and Chief Investment Officer of Intermountain Healthcare, Inc., a non‑profit healthcare system, from June 1993 to January 2021. She also has over 20 years of experience serving on other non-profit company boards, as an advisory board member to private equity firms, and serving as an investment committee member for family offices. Ms. Millard received a B.S. in Finance from Weber State University and a Master of Business Administration from Westminster College. We believe Ms. Millard is qualified to serve on our board of directors because of her extensive financial and leadership experience. | |||||||||||||

| Director | ||||||||||||||

10 | PACS 2025 Proxy Statement | |||||

| Proposals to Be Voted On | ||||||||

CONTINUING MEMBERS OF THE BOARD

Class II Directors (terms to expire at the 2026 Annual Meeting of Stockholders)

The current members of the Board who are Class II Directors are as follows:

| NAME | AGE | POSITION WITH PACS | ||||||||||||

Evelyn Dilsaver | 69 | Director | ||||||||||||

Mark Hancock | 50 | Director, Co-Founder, Executive Vice Chairman and Interim Chief Financial Officer | ||||||||||||

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

|  Evelyn Dilsaver EXPERIENCE Evelyn Dilsaver has served as a member of our board of directors since May 2024. Ms. Dilsaver has served on the board of directors of Tempur Sealy International, Inc., since 2014, QuidelOrtho Corporation, since 2022, and HealthEquity, Inc. since 2014. In the past five years, Ms. Dilsaver has also served as a director of Aéropostale Inc., HighMark Funds, Russell Exchange Traded Funds, Longs Drug Stores Corp. and Tamalpais Bancorp. She is also a member of the board of directors of a privately held corporation and real estate investment trust. Ms. Dilsaver was formerly a member of The Charles Schwab Corporation from 1991 until her retirement in 2007. During her tenure at The Charles Schwab Corporation, Ms. Dilsaver held various senior management positions within the organization, including Executive Vice President (The Charles Schwab Corporation) and President and Chief Executive Officer (Charles Schwab Investment Management). BACKGROUND Prior to becoming President and Chief Executive Officer of Charles Schwab Investment Management, a position she held from 2003 to 2007, Ms. Dilsaver held the position of Senior Vice President, Asset Management Products and Services. Ms. Dilsaver holds a B.S. in Accounting from California State University, East Bay, and is a Certified Public Accountant. We believe that Ms. Dilsaver’s extensive financial industry experience and public company board experience qualifies her to serve as a member of our board of directors. | |||||||||||||

| Director | ||||||||||||||

PACS 2025 Proxy Statement | 11 | |||||

| Proposals to Be Voted On | ||||||||

|  Mark Hancock EXPERIENCE Mark Hancock has served as our Interim Chief Financial Officer since September 2025, Executive Vice Chairman since January 2024 and a member of our board of directors since January 2013 and previously served as our Chief Financial Officer and Secretary from January 2013 to January 2024. Mr. Hancock is also a co‑founder of our company. BACKGROUND Prior to our founding, Mr. Hancock was Vice President of Finance and Treasurer of Farm Credit Mid‑America, a financial services provider, from 2010 to 2013 and served as a nursing home administrator at a facility affiliated with Plum Healthcare Group, a skilled nursing facility operator, from 2009 to 2010. From 2007 to 2009, Mr. Hancock was the Director of Corporate Finance for Steel Technologies Inc., a publicly traded steel processor, and served as a Finance Manager for Ford Motor Company, a publicly traded multinational automobile manufacturer, from 2000 to 2007. Mr. Hancock received a B.S. in Civil Engineering and a Master of Business Administration with a focus in Finance from Brigham Young University. We believe Mr. Hancock is qualified to serve on our board of directors because of his extensive leadership experience, financial expertise and strong understanding of our business. | |||||||||||||

| Co-Founder, Executive Vice Chairman and Interim Chief Financial Officer | ||||||||||||||

12 | PACS 2025 Proxy Statement | |||||

| Proposals to Be Voted On | ||||||||

Class III Directors (terms to expire at the 2027 Annual Meeting of Stockholders)

The current member of the Board who is a Class III Directors is as follows:

| NAME | AGE | POSITION WITH PACS | ||||||||||||

Jason Murray | 46 | Director, Co-Founder, Chief Executive Officer and Chairman | ||||||||||||

The principal occupations and business experience, for at least the past five years, of the Class III Director is as follows:

|  Jason Murray EXPERIENCE Jason Murray has served as our Chief Executive Officer and a member of our board of directors since January 2013 and has served as Chairman since January 2024. Mr. Murray co‑founded our company and has worked in the post‑acute sector for more than 20 years. BACKGROUND Prior to our founding, Mr. Murray was an Operations Officer for Intermountain Healthcare, Inc. a non‑profit healthcare system, from June 2011 to January 2013 where he was the interim Chief Executive Officer of Park City Medical Center from June 2012 to October 2012. From February 2009 to June 2011, Mr. Murray served as a nursing home administrator with Plum Healthcare Group, a skilled nursing facility operator. Mr. Murray received a B.A. in Healthcare Administration and a Master of Healthcare Administration from Weber State University. We believe Mr. Murray is qualified to serve on our board of directors because of his business acumen, executive leadership and extensive knowledge of our business. | |||||||||||||

| Co-Founder, CEO and Chairman | ||||||||||||||

PACS 2025 Proxy Statement | 13 | |||||

| Proposals to Be Voted On | ||||||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. Our Board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of Ernst & Young LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Ernst & Young LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2024. Neither Ernst & Young LLP nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non‑audit related services. A representative of Ernst & Young LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Ernst & Young LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2026. Even if the appointment of Ernst & Young LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

VOTE REQUIRED

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes). Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Ernst & Young LLP, we do not expect any broker non‑votes in connection with this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board unanimously recommends a vote FOR the Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2025.

14 | PACS 2025 Proxy Statement | |||||

| Proposals to Be Voted On | ||||||||

Proposal 3: Approval, on an Advisory (Non‑Binding) Basis, of the Frequency of Future Advisory Votes on the Compensation of our Named Executive Officers

In accordance with the Dodd‑Frank Wall Street Reform and Consumer Protection Act of 2010 and Rule 14a‑21 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) the Company requests that our stockholders cast a non‑binding, advisory vote regarding the frequency with which we should include in future annual proxy statements a stockholder advisory vote (the “Say‑on‑Pay Vote”) to approve the compensation of our named executive officers. The first Say‑on‑Pay Vote will occur at the Annual Meeting. By voting on this proposal, stockholders may indicate whether they would prefer that the Company provide for the Say‑on‑Pay Vote at future annual meetings every one year, every two years or every three years. Stockholders may also abstain from the vote.

After careful consideration, the Board determined that providing a Say‑on‑Pay Vote every year is the most appropriate alternative for the Company at this time. In formulating its recommendation, the Board determined that an annual advisory vote on named executive officer compensation will allow stockholders to provide their direct input on our compensation philosophy, policies and practices as disclosed in future proxy statements on a more timely and consistent basis than if the vote were held less frequently. Additionally, an annual advisory vote on executive compensation is consistent with our policy of seeking regular dialogue with our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices. We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this proposal.

This “Say‑on‑Frequency” vote is advisory, and therefore not binding on the Company, the Board or the Compensation Committee. However, the Board and the Compensation Committee value the opinions of our stockholders and intend to consider our stockholders’ views regarding how often they should have the opportunity to approve our executive compensation programs.

Stockholders of the Company will have the opportunity to specify one of four choices for this proposal on the proxy card: (1) one year; (2) two years; (3) three years; or (4) abstain. Stockholders are not voting to approve or disapprove the Board’s recommendation. Rather, stockholders are being asked to express their preference regarding the frequency of future advisory votes to approve executive compensation.

VOTE REQUIRED

The frequency that receives the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) will be the frequency recommended by stockholders. Abstentions and broker non‑votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. If no frequency receives the foregoing vote, then we will consider the option of ONE YEAR, TWO YEARS, or THREE YEARS that receives the highest number of votes cast to be the frequency recommended by stockholders.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote of “ONE YEAR” regarding the non‑binding frequency of future advisory votes on the compensation of our named executive officers.

PACS 2025 Proxy Statement | 15 | |||||

| Proposals to Be Voted On | ||||||||

Proposal 4: Approval, on an Advisory (Non‑Binding) Basis, of the Compensation of our Named Executive Officers

As required by Section 14A(a)(1) of the Exchange Act, the below resolution enables our stockholders to vote to approve, on an advisory (non‑binding) basis, the compensation of our named executive officers (also referred to as “NEOs”) as disclosed in this proxy statement. This proposal, commonly known as a “say‑on‑pay” proposal (the “Say‑On‑Pay Vote”), gives our stockholders the opportunity to express their views on our NEOs’ compensation. The Say‑on‑Pay Vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies and practices described in this proxy statement.

We encourage our stockholders to review the “Compensation Discussion and Analysis” section of this proxy statement for more information.

We believe that our compensation programs and policies for the year ended December 31, 2024 were an effective incentive for the achievement of our goals, aligned with stockholders’ interest and were worthy of stockholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Executive Compensation” set forth below in this proxy statement. We expect that our next advisory say-on-pay vote (following the non-binding advisory vote at this Annual Meeting) will occur at the 2026 Annual Meeting.

This vote is merely advisory and will not be binding upon us, our Board or the Board’s Compensation Committee, nor will it create or imply any change in the duties of us, our Board or the Board’s Compensation Committee. The Board’s Compensation Committee will, however, take into account the outcome of the vote when considering future executive compensation decisions. The Board values constructive dialogue on executive compensation and other significant governance topics with our stockholders and encourages all stockholders to vote their shares on this important matter.

As an advisory approval, this proposal is not binding upon us or our Board. However, the Compensation Committee, which is responsible for the design and administration of our executive compensation program, values the opinions of our stockholders expressed through your vote on this proposal. The Board and Compensation Committee will consider the outcome of this vote in making future compensation decisions for our NEOs. Accordingly, we ask our stockholders to vote FOR the following resolution at the annual meeting:

“RESOLVED, that the stockholders of PACS Group, Inc. approve, on an advisory (non‑binding) basis, the 2024 compensation of PACS Group, Inc.’s named executive officers as described in the Compensation Discussion and Analysis and disclosed in the Summary Compensation Table and related compensation tables and narrative disclosure set forth in PACS Group, Inc.’s Proxy Statement for the 2025 Annual Meeting of Stockholders.”

VOTE REQUIRED

The approval, on an advisory basis, will require the affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes). Abstentions and broker non‑votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors unanimously recommends a vote FOR the approval, on an advisory (non‑binding) basis, of the compensation of our named executive officers.

16 | PACS 2025 Proxy Statement | |||||

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed the audited consolidated financial statements of PACS Group, Inc. (the “Company”) for the fiscal year ended December 31, 2024 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission.

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from the Company.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10‑K for the fiscal year ended December 31, 2024.

Jacqueline Millard, Chair

Evelyn Dilsaver

Taylor Leavitt

PACS 2025 Proxy Statement | 17 | |||||

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

| FEE CATEGORY (IN THOUSANDS) | 2024 ($) | 2023 ($) | |||||||||

Audit Fees | 9,161 | 3,778 | |||||||||

Audit Related Fees | — | — | |||||||||

Tax Fees | — | — | |||||||||

All Other Fees | — | — | |||||||||

Total Fees | 9,161 | 3,778 | |||||||||

AUDIT FEES

Audit fees for the fiscal years ended December 31, 2024 and 2023 include fees for audit work performed on our consolidated financial statements, review of the quarterly financial statements, statutory financial statements of subsidiaries, other required audits, comfort letter procedures, review of periodic reports filed with the SEC and other accounting and reporting consultations, as well as review of our registration statements for our initial public offering in 2024 and subsequent secondary offering.

AUDIT RELATED FEES

Audit related fees for the fiscal years ended December 31, 2024 and 2023 include fees relating to services that were reasonably related to the audit of annual financial statements and reviews of quarterly financial statements and statutory financial statements of subsidiaries, as applicable, but not reported under Audit Fees.

AUDIT COMMITTEE PRE‑APPROVAL POLICY AND PROCEDURES

The Audit Committee has adopted a policy (the “Pre‑Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non‑audit services proposed to be performed by the independent auditor may be pre‑approved. The Pre‑Approval Policy generally provides that we will not engage Ernst & Young LLP to render any audit, audit‑related, tax or permissible non‑audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre‑approval”) or (ii) entered into pursuant to the pre‑approval policies and procedures described in the Pre‑Approval Policy (“general pre‑approval”). Unless a type of service to be provided by Ernst & Young LLP has received general pre‑approval under the Pre‑Approval Policy, it requires specific pre‑approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre‑approvals. Any proposed services exceeding pre‑approved cost levels or budgeted amounts will also require specific pre‑approval. For both types of pre‑approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business,

18 | PACS 2025 Proxy Statement | |||||

| Independent Registered Public Accounting Firm Fees and Other Matters | ||||||||

people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. The Audit Committee may, on a periodic basis, review and generally pre‑approve the services (and related fee levels or budgeted amounts) that may be provided by Ernst & Young LLP without first obtaining specific pre‑approval from the Audit Committee. The Audit Committee may revise the list of general pre‑approved services from time to time, based on subsequent determinations. The Audit Committee pre‑approved all services performed since the Pre‑Approval Policy was adopted.

PACS 2025 Proxy Statement | 19 | |||||

Executive Officers

The following table identifies our current executive officers:

| NAME | AGE | POSITION | ||||||||||||

Jason Murray(1) | 46 | Director, Co-Founder, Chief Executive Officer and Chairman | ||||||||||||

Mark Hancock(1) | 50 | Director, Co-Founder, Executive Vice Chairman and Interim Chief Financial Officer | ||||||||||||

| Joshua Jergensen | 41 | President and Chief Operating Officer | ||||||||||||

| John Mitchell | 50 | Chief Legal Officer and Secretary | ||||||||||||

| Michelle Lewis | 49 | Chief Accounting Officer | ||||||||||||

(1)See biography on pages 13 and 12 of this proxy statement for Messrs. Murray and Hancock, respectively.

Joshua Jergensen has served as our President and Chief Operating Officer since January 2023. Prior to that, Mr. Jergensen served as our Executive Vice President of Operations from July 2014 to January 2023. From October 2009 to July 2014, Mr. Jergensen was a nursing home administrator at Balboa Nursing and Rehabilitation Center, one of our affiliated skilled nursing facilities. Mr. Jergensen received a B.S. in Business Management with an emphasis in Finance from Brigham Young University and a Master of Healthcare Administration from the University of Southern California.

John Mitchell has served as our Chief Legal Officer since January 2023. Prior to that, Mr. Mitchell served as our Executive Vice President and General Counsel since joining our company in January 2017. From April 2016 to November 2016, Mr. Mitchell served as Vice President, Legal at HCP, a publicly traded REIT. Prior to that, Mr. Mitchell was Senior Vice President of Legal Affairs and Chief Compliance Officer of Skilled Healthcare Group, Inc., a publicly traded provider of post‑acute healthcare services, from January 2011 to May 2015. Mr. Mitchell received a B.A. in History and a J.D. from Brigham Young University.

Michelle Lewis has served as our Chief Accounting Officer since January 2023. Prior to that, Ms. Lewis served in various roles of increasing responsibility, including as our Controller, since joining our company in July 2018. Prior to that, Ms. Lewis owned and operated Michelle Lewis Accounting Services, PLLC, a certified public accounting firm, and also provided controller functions at a privately held healthcare organization, from January 2008 to May 2015. Ms. Lewis received a B.S. in Business Administration from the California State University, East Bay.

20 | PACS 2025 Proxy Statement | |||||

Corporate Governance

GENERAL

Our Board of Directors has adopted Corporate Governance Guidelines, a Code of Conduct, and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Corporate Governance Guidelines, and our Code of Conduct in the “Governance” section of the “Investor Relations” page of our website located at https://ir.pacs.com/, or by writing to our Secretary at our offices at 262 N. University Ave., Farmington, Utah 84025.

BOARD COMPOSITION

Our Board of Directors currently consists of five members: Evelyn Dilsaver, Mark Hancock, Taylor Leavitt, Jacqueline Millard, and Jason Murray. As set forth in our Amended and Restated Charter, the Board is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our Amended and Restated Charter and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company.

Our Amended and Restated Charter provides for the removal of any of our directors at any time with or without cause by the affirmative vote of the holders of a majority of the voting power of the then outstanding shares of our voting stock entitled to vote thereon; provided, however, that at any time when Messrs. Murray and Hancock beneficially own, in the aggregate, less than the majority of the voting power of our outstanding shares of voting stock, directors may be removed only for cause and only by the affirmative vote of the holders of at least 66 2/3% of the voting power of the then outstanding shares of our voting stock entitled to vote thereon.

STOCKHOLDERS AGREEMENT

Our Amended and Restated Charter grants Messrs. Murray and Hancock board designation rights. Mr. Murray has the right, but not the obligation, to designate (i) up to two individuals for inclusion in our slate of director nominees if he beneficially owns at least 20% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO or (ii) one individual for inclusion in our slate of director nominees if he beneficially owns less than 20% but at least 10% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO. Mr. Hancock has the right, but not the obligation, to designate (i) up to two individuals for inclusion in our slate of director nominees if he beneficially owns at least 20% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO or (ii) one individual for inclusion in our slate of director nominees if he beneficially owns less than 20% but at least 10% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO.

Each of Messrs. Murray and Hancock also have the right to fill any vacancies created by reason of death, resignation, disqualification or removal of their respective designees. These rights are also affirmed in the Stockholders Agreement that we entered into with Messrs. Murray and Hancock, and these rights will terminate upon the termination of the Stockholders Agreement. See “Certain Relationships and Related Party Transactions—Stockholders Agreement” for more information. If the number of individuals that Messrs. Murray and Hancock have the right to designate is decreased because of a decrease in their respective ownership or upon termination of the Stockholders Agreement, then the corresponding designee (if such designee is serving on our board of directors) may remain on our board of directors through the end of his or her then current term; provided, that a director may resign at any time regardless of the period of time left in his or her then current term.

PACS 2025 Proxy Statement | 21 | |||||

| Corporate Governance | ||||||||

As a result, Messrs. Murray and Hancock each have the right to designate two directors for nomination to our board of directors, and will collectively have the right to designate four directors, which represents the four out of our current five member board of directors.

Furthermore, our Amended and Restated Charter provides that, at any time when Messrs. Murray and Hancock beneficially own, in the aggregate, at least a majority of the voting power of our outstanding shares of voting stock, our stockholders may take action by written consent without a meeting, and at any time when Messrs. Murray and Hancock beneficially own, in the aggregate, less than the majority of the voting power of our outstanding shares of voting stock, our stockholders may not take action by written consent and may only take action at a meeting of stockholders. As a result, for so long as Messrs. Murray and Hancock own, in the aggregate, a majority of the voting power of our outstanding shares of our voting stock, they may take action by written consent without a meeting of stockholders.

DIRECTOR INDEPENDENCE

Our Board of Directors has determined that Evelyn Dilsaver, Taylor Leavitt and Jacqueline Millard each qualify as “independent” in accordance with the listing requirements of the New York Stock Exchange (“NYSE”). In making these determinations, our Board of Directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. Based on his relationship with the Company, each of Messrs. Murray and Hancock do not qualify as independent under NYSE Rules.

FAMILY RELATIONSHIPS

There are no family relationships among any of our directors or executive officers.

EXECUTIVE SESSIONS OF NON-MANAGEMENT DIRECTORS

Our non‑management directors meet in executive session without management directors or other members of management present on a regular basis. We also hold an executive session including only independent directors at least once per year. Each executive session of the non‑management directors or the independent directors is presided over by the lead independent director.

CONTROLLED COMPANY EXEMPTION

We are a “controlled company” under the rules of the NYSE. The rules of the NYSE define a “controlled company” as a company of which more than 50% of the voting power for the election of directors is held by an individual, a group, or another company. As of the Record Date, Messrs. Murray and Hancock beneficially own approximately 70% of the combined voting power of our outstanding capital stock. As a result, we qualify for exemptions from, and have elected not to comply with, certain corporate governance requirements under the NYSE rules. Even though we are a controlled company, we are required to comply with the rules of the SEC and the NYSE relating to the membership, qualifications, and operations of the audit committee, as discussed below.

If we cease to be a controlled company and our common stock continues to be listed on the NYSE, we will be required to comply with these requirements by the date our status as a controlled company changes or within specified transition periods applicable to certain provisions, as the case may be.

DIRECTOR CANDIDATES

The Nominating and Corporate Governance Committee is primarily responsible for searching for qualified director candidates for election to the Board and filling vacancies on the Board. To facilitate the search process, the Nominating and Corporate Governance Committee may solicit current directors and executives of the Company for the names of potentially qualified candidates or ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the

22 | PACS 2025 Proxy Statement | |||||

| Corporate Governance | ||||||||

search for qualified candidates, or consider director candidates recommended by our stockholders. Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the Nominating and Corporate Governance Committee for candidates for election as a director. Each of Taylor Leavitt and Jacqueline Millard was initially recommended to serve on our Board by Messrs. Murray and Hancock, the Company’s then-serving Chief Executive Officer and Chief Financial Officer, respectively.

In evaluating the suitability of individual candidates (both new candidates and current Board members), the Nominating and Corporate Governance Committee, in recommending candidates for election, and the Board, in approving (and, in the case of vacancies, appointing) such candidates, may take into account many factors, including: high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments; experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience as a board member of another publicly held company; professional and academic experience relevant to the Company’s industry; leadership skills; experience in finance and accounting and/or executive compensation practices; and whether the candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable; and geographic background, gender, age and ethnicity. In addition, the Board considers whether there are potential conflicts of interest with the candidate’s other personal and professional pursuits. The Board also monitors the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the Nominating and Corporate Governance Committee, c/o Secretary, PACS Group, Inc., 262 N. University Ave., Farmington, Utah 84025. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder‑recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

COMMUNICATIONS FROM INTERESTED PARTIES

The Board will give appropriate attention to written communications that are submitted by stockholders or other interested parties, and will respond if and as appropriate. Our Secretary is primarily responsible for monitoring communications from stockholders and other interested parties, and for providing copies or summaries to the directors as the Secretary considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Secretary and Chairman of the Board consider to be important for the directors to know. In general, communications relating to corporate governance and long‑term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications. Stockholders who wish to send communications on any topic to the Chairman of the Board, the chairperson of any of the Audit, Nominating and Corporate Governance, and Compensation Committees, the independent or non‑management directors, or the Board as a whole, should address such communications to the applicable party or parties in writing: c/o Secretary, PACS Group, Inc., 262 N. University Ave., Farmington, Utah 84025.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee currently consists of Evelyn Dilsaver, Taylor Leavitt, and Jacqueline Millard, with Mr. Leavitt serving as Chair. No member of our Compensation Committee is an officer or employee of the Company.

During 2024, none of our executive officers served as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

PACS 2025 Proxy Statement | 23 | |||||

| Corporate Governance | ||||||||

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Our Amended and Restated Bylaws and Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. Currently, the roles are combined, with Jason Murray serving as Chairman of the Board and Chief Executive Officer. In addition, Mark Hancock serves as Vice Chairman and Chief Financial Officer The primary responsibilities of our Chairman of the Board include helping to develop board meeting schedules and agendas; working with other directors to provide the senior leadership feedback on the quality, quantity and timeliness of the information provided to the Board; presiding over Board meetings; representing the Board in communications with stockholders; providing input on the structure and design of the Board; and performing other duties as the Board may determine from time to time. Our Board has determined that combining the roles of Chairman of the Board and Chief Executive Officer is best for our Company and its stockholders at this time because it promotes unified leadership by Mr. Murray given his deep knowledge of our business and strategy and ability to draw on that experience in order to provide the Board leadership to focus its discussions, review and oversight of the Company’s strategy, business and operating and financial performance and allows for a single, clear focus for management to execute such strategy, business and operating and financial performance goals. Our Board is comprised of individuals with extensive experience in the healthcare industry and public company management. For these reasons and because of the strong leadership of Mr. Murray, our Board has concluded that our current leadership structure is appropriate at this time.

However, our Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate. The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to provide robust oversight of management. The Board believes that, given the dynamic and competitive environment in which we operate, the optimal board leadership structure may vary as circumstances warrant. The Board periodically reviews its leadership structure to determine whether it continues to best serve the Company and its stockholders. From time to time, the Company proactively engages with stockholders throughout the year to learn their perspectives on significant issues, and intends to continue to do so, including with respect to gathering stockholder perspectives on the Board’s leadership structure. Our Corporate Governance Guidelines provide that whenever the Chairman of the Board is also a member of management or is a director that does not otherwise qualify as an independent director, the independent directors may in their discretion elect a lead independent director whose responsibilities include, but are not limited to, presiding over all meetings of the Board at which the Chairman of the Board is not present, including any executive sessions of the independent directors; approving Board meeting schedules and agendas; and acting as the liaison between the independent directors and the Chairman of the Board, as appropriate. Mr. Leavitt currently serves as the lead independent director.

Risk assessment and oversight are an integral part of our governance and management processes. Our Board of Directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day‑to‑day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the Board of Directors at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

Our Board of Directors is responsible for overseeing our risk management process. Our Board of Directors focuses on our general risk management strategy and the most significant risks facing us, and oversees the implementation of risk mitigation strategies by management. Our Audit Committee is responsible for discussing the Company’s policies with respect to risk assessment and risk management and overseeing the management of the Company’s financial risks and information technology risks, including cybersecurity and data privacy risks. The Committee is also responsible for discussing with management the steps management has taken to monitor and control these risks. Our Nominating and Corporate Governance oversees risks associated with environmental and social matters. Our Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit Committee typically reports to the full Board at each quarterly Board meeting, as does the Nominating Committee and the Compensation Committee to the extent they have updates, and also as appropriate on its risk oversight activities and on any matter that rises to the level of a material or enterprise level of risk. The Board does not believe that its role in the oversight of our risks affects the Board’s leadership structure.

24 | PACS 2025 Proxy Statement | |||||

| Corporate Governance | ||||||||

CODE OF ETHICS

We have a written Code of Conduct that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the Code of Conduct on our website, https://ir.pacs.com/, in the “Governance Documents” section under “Governance”. In addition, we intend to post on our website all disclosures that are required by law or the rules of the NYSE concerning any amendments to, or waivers from, any provision of the Code of Conduct.

INSIDER TRADING COMPLIANCE POLICY

The Company has an Insider Trading Compliance Policy (the “Policy”) governing the purchase, sale and other dispositions of the Company’s securities that applies to all Company personnel, including directors, officers, employees, and other covered persons. The Company also follows procedures for the repurchase of its securities. The Company believes that its insider trading policy and repurchase procedures are reasonably designed to promote compliance with insider trading laws, rules and regulations, and listing standards applicable to the Company. The Policy prohibits Covered Persons from purchasing financial instruments such as prepaid variable forward contracts, equity swaps, collars, and exchange funds, or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities, or that may cause a Covered Person to no longer have the same objectives as the Company’s other stockholders.

ATTENDANCE BY MEMBERS OF THE BOARD OF DIRECTORS AT MEETINGS