S-1: General form of registration statement for all companies including face-amount certificate companies

Published on September 3, 2024

As filed with the U.S. Securities and Exchange Commission on September 3, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under The Securities Act of 1933

(Exact name of registrant as specified in its charter)

| 8051 | ||||||||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.) | ||||||

(801 ) 447-9829

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jason Murray

Chief Executive Officer

PACS Group, Inc.

262 N. University Ave.

Farmington, Utah 84025

(801) 447-9829

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

B. Shayne Kennedy

J. Ross McAloon

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, CA 92626

(714) 540-1235

|

John Mitchell

Chief Legal Officer and General Counsel

262 N. University Ave.

Farmington, Utah 84025

(801) 447-9829

|

Benjamin K. Marsh

Adam V. Johnson

Goodwin Procter LLP

The New York Times Building

620 Eighth Avenue

New York, NY 10018

(212) 813-8800

|

||||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ |

Accelerated filer | ☐ |

|||||||||||

☒ |

Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated September 3, 2024.

PRELIMINARY PROSPECTUS

13,888,890 Shares

Common Stock

We are offering 2,777,778 shares of our common stock, and the selling stockholders identified in this prospectus are offering 11,111,112 shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. Our common stock is listed on the New York Stock Exchange under the symbol “PACS.” On August 30, 2024, the last reported sale price of our common stock as reported on the New York Stock Exchange was $39.67 per share.

The selling stockholders have granted the underwriters an option for a period of up to 30 days to purchase up to an additional 2,083,332 shares of our common stock from them at the public offering price, less the underwriting discounts and commissions.

Following this offering, our founders, Messrs. Murray and Hancock, will collectively own a significant majority of our common stock, representing approximately 73.7% of the voting power of our common stock (or approximately 72.4% if the underwriters exercise their option to purchase additional shares of our common stock from the selling stockholders in full). In addition, pursuant to the terms of our amended and restated certificate of incorporation (Amended and Restated Charter), our founders are able to control corporate matters for the foreseeable future. For example, each founder has the right to designate (i) up to two individuals for inclusion in our slate of director nominees if such founder beneficially owns at least 20% of the aggregate number of shares of common stock outstanding immediately following the completion of our initial public offering or (ii) one individual for inclusion in our slate of director nominees if such founder beneficially owns less than 20% but at least 10% of the aggregate number of shares of common stock outstanding immediately following the completion of our initial public offering. Accordingly, each founder currently has the right to designate two directors, and our founders currently collectively have the right to designate four directors, which represents four out of our five member board of directors. These rights are affirmed in the Stockholders Agreement (as defined herein). In addition, pursuant to the terms of our Amended and Restated Charter, for so long as our founders beneficially own, in the aggregate, the majority of the voting power of our outstanding shares of voting stock, our founders are able to remove any of our directors at any time with or without cause and may take action by written consent without a meeting of stockholders. If our founders beneficially own, in the aggregate, less than the majority of the voting power of our outstanding shares of voting stock, directors may be removed only for cause and only by the affirmative vote of the holders of at least 66 2/3% of the voting power of the then outstanding shares of our voting stock entitled to vote thereon and our stockholders may not take action by written consent, which has the effect of requiring all stockholder actions to be taken at a meeting of our stockholders. Our Amended and Restated Charter authorizes our board of directors to establish and determine, among others, the voting, board representation and other rights or preferences of one or more series of preferred stock, and our board of directors may determine to issue additional shares of common stock, in each case without stockholder approval. This concentrated control, due to both the provisions of the Amended and Restated Charter and the Stockholders Agreement and the voting power of our founders, will preclude your ability to influence corporate matters for the foreseeable future, including with respect to the composition of our board of directors, the election and removal of directors, the authorization and issuance of additional shares of our common stock that would be dilutive to you, the issuance of shares of preferred stock that could be dilutive to you and could have disparate voting rights, amendments to our organizational documents, and any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transactions requiring stockholder approval.

We are a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. As a “controlled company,” we may elect to rely on exemptions from certain corporate governance standards of the New York Stock Exchange.

See the sections titled “Management—Director Independence and Controlled Company Exception,” “Certain Relationships and Related Party Transactions—Stockholders Agreement” and “Description of Capital Stock.”

Investing in our common stock involves risks. See the section titled “Risk Factors” beginning on page 21 to read about the factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | ||||||||||

Public offering price |

$ |

$ |

|||||||||

Underwriting discounts and commissions(1)

|

$ |

$ |

|||||||||

| Proceeds, before expenses, to us | $ |

$ |

|||||||||

Proceeds, before expenses, to the selling stockholders |

$ |

$ |

|||||||||

__________________

(1)We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See the section titled “Underwriting (Conflicts of Interest)” for a description of the compensation payable to the underwriters.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2024.

Citigroup |

J.P. Morgan |

Truist Securities |

||||||

RBC Capital Markets |

Goldman Sachs & Co. LLC |

UBS Investment Bank |

||||||

Stephens Inc. |

Oppenheimer & Co. | |||||||

Prospectus dated , 2024.

TABLE OF CONTENTS

| Page | |||||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission (SEC) prepared by or on behalf of us that we have referred to you. Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide you with any information other than that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, the selling stockholders, nor the underwriters take responsibility for, and can provide assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of our common stock offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have changed since such date.

For investors outside of the United States: We have not, the selling stockholders have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

i

GENERAL INFORMATION

Industry, Market and Other Data

This prospectus contains estimates, projections and information concerning our industry, our business and data regarding the market size and growth rates of the markets in which we participate. Some data and statistical and other information are based on independent reports from third parties, as well as industry and general publications and research, surveys and studies conducted by third parties. Some data and statistical and other information are based on internal estimates and calculations that are derived from publicly available information, research we conducted, internal surveys, our management’s knowledge of our industry and their assumptions based on such information and knowledge, which we believe to be reasonable.

In each case, this information and data involves a number of assumptions and limitations. Industry publications and other reports we have obtained from independent parties may state that the data contained in these publications or other reports have been obtained in good faith or from sources considered to be reliable, but they do not guarantee the accuracy or completeness of such data. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause our future performance to differ materially from the assumptions and estimates made by third parties and us.

Trademarks, Trade Names and Service Marks

PACS, our logos and our other registered or common law trade names, trademarks or service marks appearing in this prospectus are the property of PACS Group, Inc. or our subsidiaries. This prospectus contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. Solely for convenience, the trade names, trademarks and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights thereto or that the applicable owner of these trade names, trademarks and service marks will not assert, to the fullest extent under applicable law, its rights thereto.

Basis of Presentation

Certain monetary amounts, percentages and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Percentage amounts included in this prospectus have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this prospectus may vary from those obtained by performing the same calculations using the figures in our combined/consolidated financial statements included elsewhere in this prospectus. Accordingly, certain other figures and amounts that appear as totals in this prospectus may not be the arithmetic aggregation of the figures or amounts that precede them, and figures or amounts expressed as a percentage may not total 100% or be the arithmetic aggregation of the percentages that precede them.

ii

PROSPECTUS SUMMARY

This summary highlights selected information contained in more detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Special Note Regarding Forward-Looking Statements,” and our audited combined/consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “we,” “us,” “our,” the “Company,” “PACS” and similar references in this prospectus refer to PACS Group, Inc. together with its consolidated subsidiaries.

Business Overview

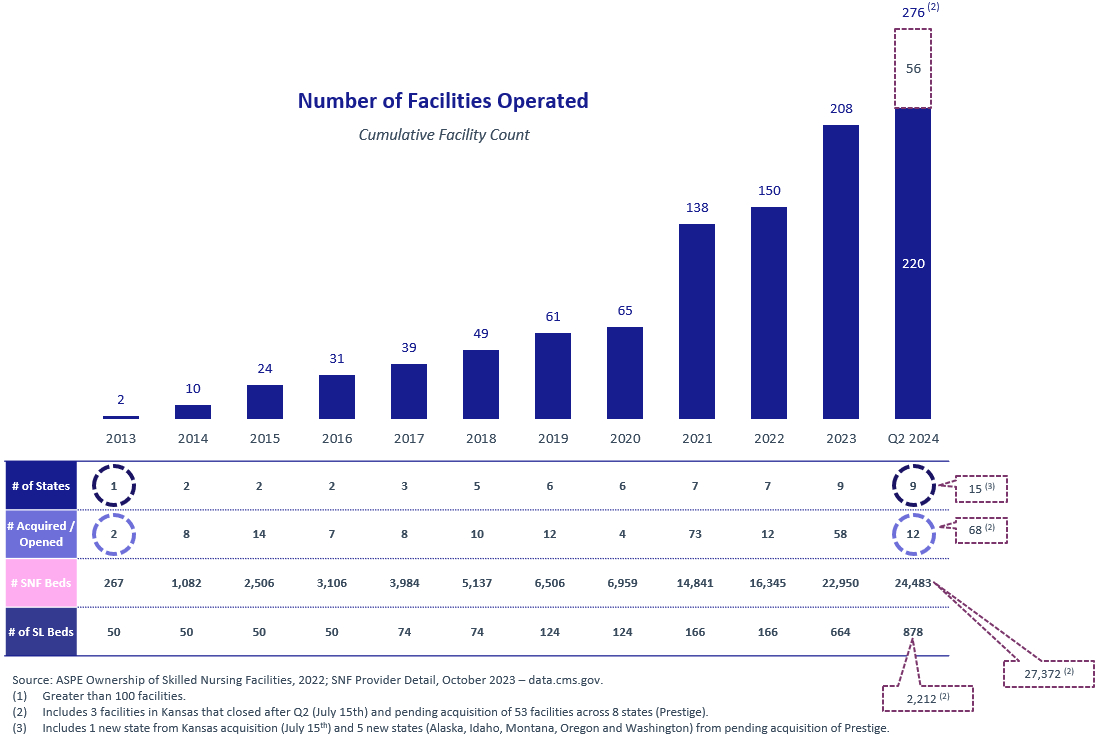

We are a leading post-acute healthcare company primarily focused on delivering high-quality skilled nursing care through a portfolio of independently operated facilities. Founded in 2013, we are one of the largest skilled nursing providers in the United States based on number of facilities, with 276 post-acute care facilities across 15 states serving over 29,000 patients daily as of September 1, 2024. We also provide senior care, assisted living, and independent living options in some of our communities. Our significant historical growth has been primarily driven by our expertise in acquiring underperforming long-term custodial care skilled nursing facilities and transforming them into higher acuity, high value-add short-term transitional care skilled nursing facilities. We believe our success is driven in significant part by our decentralized, local operating model, through which we empower local leaders at each facility to operate their facility autonomously and deliver excellence in clinical quality and a superior experience for our patients. We provide our independently operated facilities with a comprehensive suite of technology, support, and back-office services that allow local leadership teams to focus more of their time and effort on providing quality care to patients. We believe our operating model delivers value to all of our healthcare stakeholders, including patients and families, referring providers, payors, and administrators and clinicians.

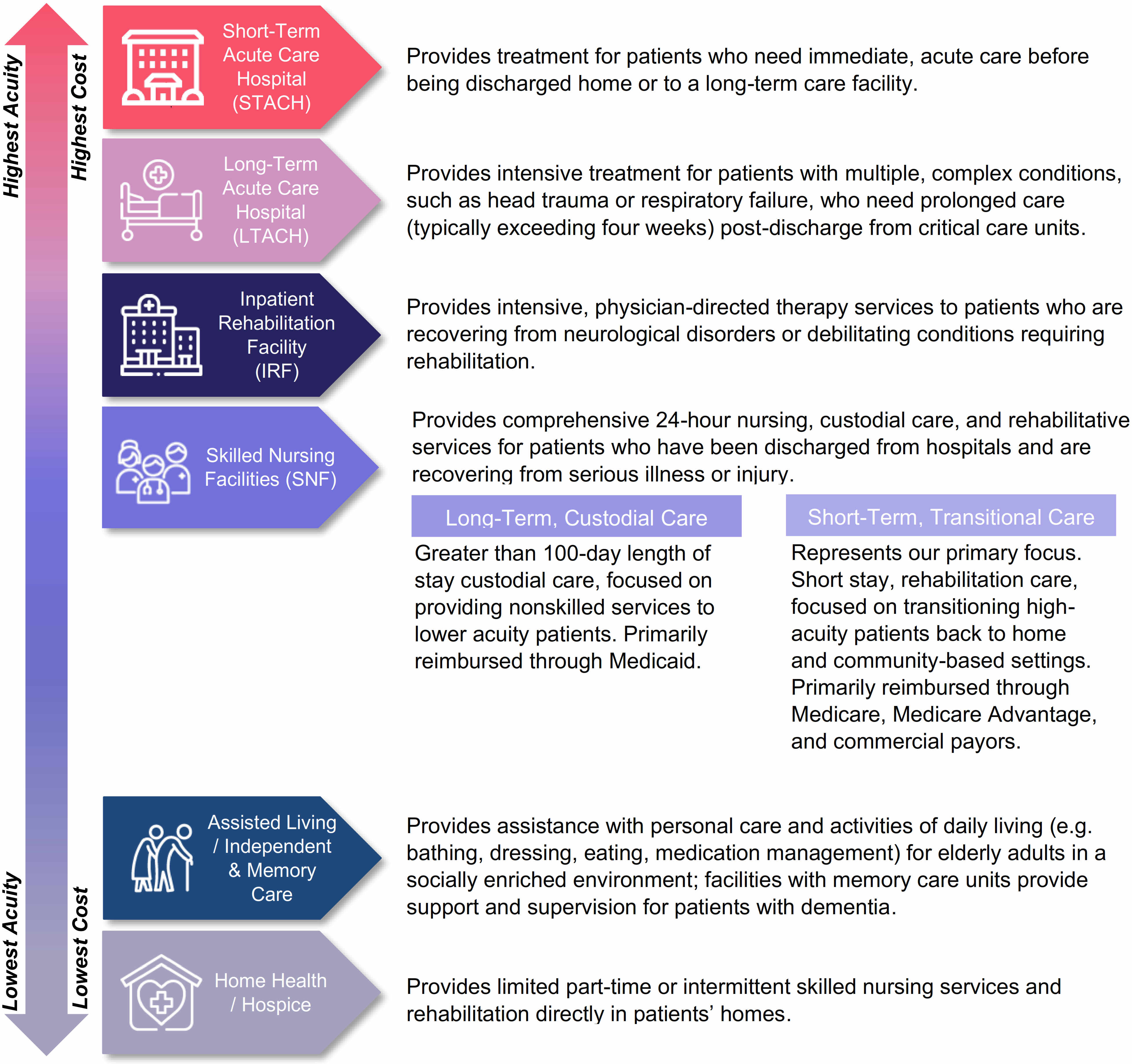

The post-acute care ecosystem serves individuals who need additional help recuperating from acute conditions, illnesses, or serious medical procedures after they have been discharged from the hospital. This ecosystem ranges from higher acuity, higher-cost settings, such as long-term acute care hospitals and inpatient rehabilitation facilities, to lower acuity, lower-cost settings, such as assisted living facilities, and home health. Skilled nursing facilities (SNFs) are positioned at the center of this ecosystem and play an essential role in providing cost efficient facility-based care to patients that have been discharged from hospitals but still require 24-hour in-patient services. SNFs can provide both long-term custodial care and higher value short-term transitional care. The SNF industry is large and growing, with the Centers for Medicare & Medicaid Services (CMS) expecting total industry expenditures to increase from $209.3 billion in 2023 to $337.4 billion in 2032, representing a compound annual growth rate (CAGR) of 5.4%. Based on the number of facilities as reported by CMS, we are one of the largest SNF operators in the United States. We are primarily focused on providing higher value short-term transitional care and believe we are uniquely positioned to capitalize on the current underlying trends within the SNF industry and to capture a growing portion of the expected demand.

We believe that healthcare is local and we operate through a decentralized model, recognizing that each patient, facility, and community is unique. To that end, we believe that our local leaders and employees understand the distinct needs and priorities of their patients, staff, and facilities and are best positioned to make clinical and operational decisions in order to optimize patient outcomes and experience. To facilitate this, each of our facilities operates independently, led by a facility administrator and his or her interdisciplinary team of medical directors, nurses, therapists, specialty consultants, and operators. To assist these local teams in achieving their best clinical and operating potential, we provide each facility with access to PACS Services. PACS Services is a comprehensive suite of offerings, including accounting, finance, human resources, payroll, accounts receivable and payable, legal, and risk management services, as well as a robust suite of technology tools. We operate in a highly regulated industry with stringent regulatory compliance obligations, which requires robust regulatory compliance operations. Failure to operate in compliance with applicable laws and regulations could require significant expenditures and result in regulatory deficiencies and other regulatory penalties. PACS Services functions to support our regulatory compliance obligations across our organization, including through controlled billing and cost reporting practices and

1

legal, risk management, and compliance support. PACS Services also provides teams of regional professionals available as resources to each facility, including a regional vice president (RVP) and regional clinical and non-clinical directors and consultants. We developed PACS Services to be a resource to help reduce administrative burden so that local leadership teams can focus on making decisions that improve the care, well-being, and quality of life of their patients.

We believe that talented local leadership is critical to the success of our model of independently operated, centrally supported facilities. At the facility level, administrators are effectively the chief executive officers, and together with other local licensed professionals, are ultimately responsible for the operations of their respective facilities. We seek to recruit, train, and reward dynamic administrators for our facilities, and rely on them to work with their interdisciplinary teams to implement policies and procedures that are appropriate and effective and result in positive outcomes. We support the delivery of excellent care by building excellent teams. We believe our model attracts high caliber, entrepreneurial professionals who value having considerable autonomy, accountability, and aligned incentives. We provide these professionals with leadership and industry training, guidance, and operational support. Our model is intended to align local leaders’ incentives with facility and organizational success, encouraging them to dedicate themselves to the long-term future of their facilities. To create such alignment, we have developed an administrator compensation structure that prioritizes quality of care and operational and financial performance. Our administrators understand that a well-performing facility is the result of providing quality care in an environment of healing and caring, and one that is appropriately staffed, supplied, and equipped to meet the needs of its patients. This dedicated focus by our administrators and their local teams on patient outcomes drives demand for our services and can ultimately result in higher patient census and profitability. We also seek to provide opportunities for upward career mobility, with many of our administrators being promoted from within our company to roles of increasing levels of responsibility. Our culture of meritocracy and pride of ownership has helped us retain experienced facility administrators as well as RVPs who had average industry experience of 7.3 years, as of June 30, 2024. For the year ended December 31, 2023, we had a voluntary turnover rate of 3.1% among our facility administrators.

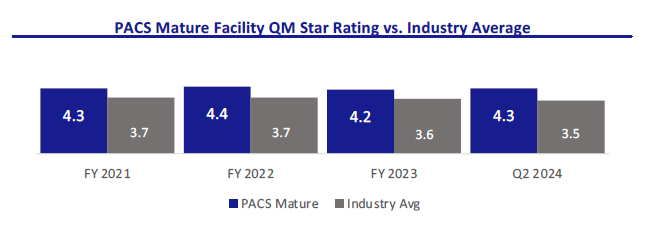

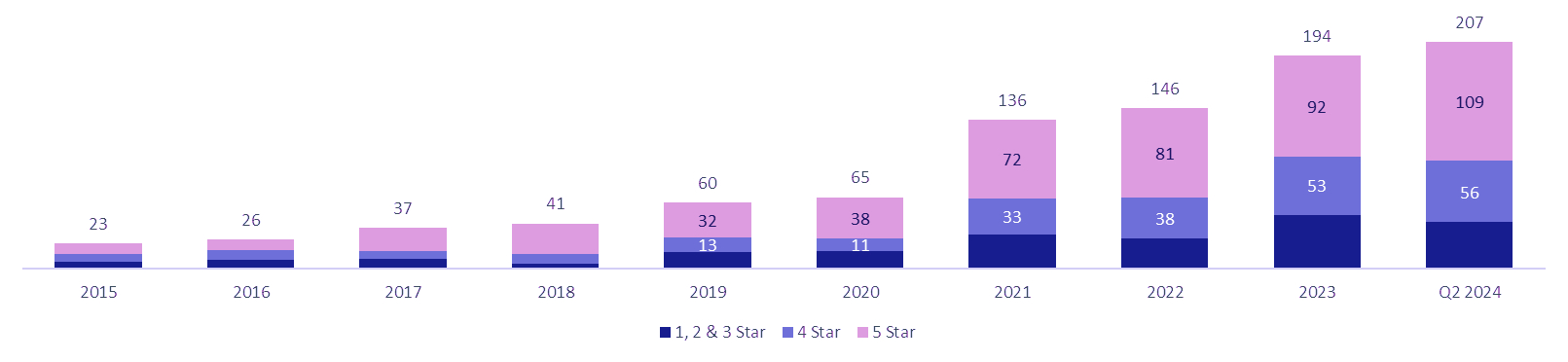

Excellence in clinical quality and experience for our patients is at the forefront of our mission. We believe our focus on quality is reflected in our CMS Quality Measures (QM) Star rating, occupancy rate, and skilled mix by nursing patient days (which refers to the number of days our Medicare and managed care patients receive skilled nursing services at SNFs as a percentage of the total number of days that patients from all payor sources receive skilled nursing services at SNFs for any given period). The QM Star rating is a number between 1 and 5 that is assigned to SNFs that participate in Medicare or Medicaid, and is based on an aggregate score across a range of quality reporting program requirements. As of June 30, 2024, our average QM Star rating across all our facilities was 4.3 Stars, compared to the industry average of 3.5 Stars. For the six months ended June 30, 2024 and the years ended December 31, 2023, 2022 and 2021, our average occupancy rate across our Mature facilities, which we define as facilities purchased more than 36 months prior to the measurement date, was 94%, 93%, 92% and 88% , respectively, compared to the industry average of 76%, 76%, 74% and 71%. For the six months ended June 30, 2024, our skilled mix by nursing patient days was 30%.

We have historically grown primarily through our disciplined and balanced acquisition strategy. We aim to create value by identifying and acquiring underperforming custodial care facilities and converting them into higher-value short-term transitional care facilities by investing in clinical teams and processes and upgrading technology, equipment, training, staffing, aesthetics, and other aspects of the business. The resources and guidance offered by PACS Services is key to rapid integration of new facilities and provides our local leadership teams with an effective technology infrastructure, support tools, and regional support teams that allow local leadership to focus on operational improvements. Our facilities generally undergo an up to three-year post-acquisition transition period. During this period, we seek to implement best practices designed to realize and sustain the facility’s full potential. These practices often result in significant improvements to clinical quality and other operational metrics, including skilled mix, occupancy rates and payor contracting. We believe the results of our acquisition strategy are demonstrated by our high average QM Star rating and occupancy rate for Mature facilities of 4.3 and 94%, respectively, as of June 30, 2024. As of June 30, 2024, the average QM Star rating and occupancy rate for New facilities, which we define as facilities purchased less than 18 months prior to the measurement date, was 4.1 and 84%, respectively.

2

Our portfolio of owned and leased properties is strategically located in 15 states as of September 1, 2024: Alaska, Arizona, California, Colorado, Idaho, Kansas, Kentucky, Missouri, Montana, Nevada, Ohio, Oregon, South Carolina, Texas, and Washington. We anticipate that available acquisition opportunities will enable us to further penetrate these 15 states and to enter new states in the future. We believe our current markets are attractive and that each state in which we operate have unique benefits, such as favorable reimbursement dynamics, high barriers to entry, or population growth of adults aged 65 and older, which is our primary patient demographic. We generally look for similar attributes in new markets that we enter. As of June 30, 2024, we leased 170 facilities, owned partial real estate interests in an additional 12 leased facilities through joint ventures managed by third parties, and directly owned the real estate at 38 facilities. As we continue to grow, we intend to explore additional purchases of real-estate assets, through purchase options or right-of-first refusals in existing leases, as well as acquisitions and de novo construction of purpose-built facilities.

For the six months ended June 30, 2024 and 2023, we generated total revenue of $1.9 billion and $1.5 billion, respectively. A substantial portion of our revenue is generated from payments from third-party payors, including Medicare and Medicaid, which represent our largest sources of revenue and accounted for 36.6% and 38.4% of our total revenue for the six months ended June 30, 2024, respectively, and 44.8% and 32.9% of our total revenue for the six months ended June 30, 2023, respectively. For the six months ended June 30, 2024, we generated total net income of $38.2 million, total operating expense of $1.8 billion and Adjusted EBITDA of $188.2 million. For the six months ended June 30, 2023, we generated total net income of $58.8 million, total operating expense of $1.4 billion and Adjusted EBITDA of $122.4 million. For the year ended December 31, 2023, we generated total revenue of $3.1 billion, and Medicare and Medicaid accounted for 38.6% and 37.6% of our total revenue, respectively. For the year ended December 31, 2022, we generated total revenue of $2.4 billion, and Medicare and Medicaid accounted for 47.6% and 30.2% of our total revenue, respectively. For the year ended December 31, 2023, we generated total net income of $112.9 million, total operating expense of $2.9 billion and Adjusted EBITDA of $237.5 million. For the year ended December 31, 2022, our total operating expenses were $2.2 billion, and we generated net income of $150.5 million and Adjusted EBITDA of $255.5 million. As of June 30, 2024, we had total long-term liabilities of $2.9 billion. We intend to use all of the net proceeds to us from this offering to repay a portion of the amounts outstanding under our Amended and Restated 2023 Credit Facility. See the section titled “Use of Proceeds” for additional information. Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, see the section titled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Key Skilled Services Metrics and Non-GAAP Financial Measures—Non-GAAP Financial Measures.”

Our Value Proposition

We believe that our operating model creates meaningful value for patients and their families, our referring providers, our payors, and our administrators and clinicians.

Value Proposition for Patients and Families

•Coordinated care. We empower team members at every level through skillful training, shared resources, and a collaborative spirit. We help deliver coordinated care before, during, and after a patient’s stay with us. Prior to admission, our administrators or other facility leaders meet with patients and their families, as well as hospital discharge planners, to plan for the patient’s discharge and enable a seamless transition to our facility. During a stay with us, our local facility team coordinates closely with physicians to deliver high-touch, high-quality care for patients. As care nears completion, we meet with our patients, their families, home health agencies and downstream care providers to plan for and ensure a smooth transition.

•Outstanding patient experience. Our goal is to provide each patient with superior care and an outstanding experience. When patients arrive at our facilities they are greeted by a warm, inviting, and modern environment. We often upgrade facility infrastructure shortly after acquisition and perform periodic refreshes, to ensure our facilities are comfortable and well-equipped to serve patients across a wide range of acuities with a primary focus on high acuity patients. High acuity patients generally require higher levels of medical care or monitoring due to conditions or complications that cannot be easily managed, and often

3

need more nursing resources and attention to maintain their quality of life. We believe our investment in modern equipment and technology allows our facility care teams to identify and respond to patient needs and provide them high quality care in a timely manner. Moreover, our clinicians are highly trained, have significant experience, and are able to leverage bespoke care plans to help ensure that patients receive care tailored to their particular needs.

Value Proposition for Referring Providers

•Strategic and seamless transitions. Our administrators and their interdisciplinary teams seek to become a preferred partner by developing a deep understanding of local referring providers’ and their patients’ needs. Administrators often visit with patients and their families prior to discharge to plan for and map out a smooth admission to our facility. Once a plan is set, the facility team endeavors to quickly and seamlessly transition new patients to the facility with a focus on ensuring continuity of care in the transition. We believe that hospitals and other referral sources consider our facilities to be attractive discharge options because we are able to care for a wide variety of patient needs, and are often able to accept admissions on short notice, including on nights and weekends. Our flexibility helps hospitals maintain adequate bed availability to meet their other patients' needs.

•Trusted partner with quality care. Our ability to care for higher acuity patients allows referring providers to have confidence that we will be able to adequately care for their patients and assist them in their recovery. Our facilities seek to work with patients’ doctors to create personalized care plans to help ensure that patients stay on track in their recovery and to reduce the likelihood of their readmission to the hospital. Our facility teams also seek to coordinate closely with a patient’s home health agency or other post-SNF caregivers to try to ensure the patient’s transition home or to their next care setting is successful. This close coordination allows us, where warranted, to directly readmit patients back to our facility who would have otherwise been readmitted to an acute care hospital in the event they have a change of condition after leaving our facility.

Value Proposition for Payors

•Higher value site of care. We believe we provide high acuity care in a cost-effective setting and are able to quickly transition patients from the acute care setting, reducing length of stay and delivering more overall value for payors. Moreover, we believe we provide payors with a high-quality alternative to higher cost post-acute sites of care. For example, according to MedPAC, SNFs are the lowest cost facility-based post-acute healthcare, costing an average of $550 per covered day compared to $1,850 and $1,753 per covered day for inpatient rehabilitation facilities and long-term acute care hospitals, respectively.

•Robust culture of compliance. We focus on instilling a unified, cohesive culture of innovation and compliance that we believe provides consistency in our results and confidence in our facilities as an attractive care option for patients. Our rigorous approach to billing integrity, our independent internal compliance function, and our regular facility billing audits are intended to provide a foundation of trust and collaboration that makes us a natural choice for payors.

Value Proposition for Administrators and Clinicians

•Autonomy and aligned compensation. Each facility administrator is, in effect, the local “CEO” and dedicated leader of their facility. Alongside their local interdisciplinary team, they are empowered to make real-time decisions locally around all aspects of their business and to manage their individual facility in a way that they believe is best suited to address their local market and its needs. We have designed a transparent incentive model for our administrators that is intended to align their compensation with the quality of care and operational and financial performance of their facility. We provide them the tools and the autonomy to optimize the performance of their facility, and we reward them for success in their efforts. We believe that a well-performing facility is the result of providing quality care in an environment of healing and caring and one that is appropriately staffed, supplied, and equipped to meet the needs of its

4

patients. This dedicated focus by our administrators and their local teams on patient outcomes drives demand for our services and can ultimately result in higher patient census and profitability.

•Robust technology enabled operating infrastructure. We developed PACS Services to reduce the managerial and operational burden on our administrators, allowing them to focus on leading their facilities and spending more time with patients and staff. PACS Services includes a robust suite of technology tools that provide detailed real-time data and trends that local clinicians and leadership teams can use to monitor and improve operational performance. PACS Services also includes regional support teams that leverage their deep tenure and experience across markets to provide higher-level support to local leaders on complex issues, including billing and cost reporting practices and regulatory compliance obligations. The regional teams are connected to and support the facilities within their designated region, which enables them to identify best practices and trends within the region, communicate those across their region, and provide facility-level support as needed.

•Highly entrepreneurial career development. By providing our administrators with autonomy in the operation of their facility, we believe we create a highly entrepreneurial environment that encourages and rewards leaders to optimize operational performance. We empower our clinicians to do the same and provide top performers the opportunity to progress via training for higher skill licenses and certifications. People are provided the opportunity to advance to become an administrator through our Administrator-in-Training program, and to join a regional leadership team. For example, in the year ended December 31, 2023, we promoted 26 of our administrators from within our organization after participating in our Administrator-in-Training program, and 12 of our RVPs were previously successful administrators with us.

Our Competitive Strengths

We believe our success is driven by the following competitive strengths:

Superior Overall Quality

Excellence in clinical quality and experience for our patients is at the forefront of our mission and is reflected in our above-industry average QM Star rating and occupancy rate. Our facilities employ skilled administrators and clinicians and equip them with purpose-built technology and support so they can operate at the top of their professional capacity and deliver high-quality care for patients. We continuously invest in our people, processes, and facilities to promote an excellent patient experience. We believe we deliver superior overall quality that has contributed to our reputation as a provider-of-choice in our communities, driving greater referral volumes from referring providers who value our high standards.

Decentralized Market-Driven Operating Model

Our decentralized model emphasizes local operational autonomy. We believe that placing decision-making power at the local level with teams who understand the needs of their patients and their communities facilitates responsiveness and adaptability to evolving patient needs and facility and community factors. We believe the empowerment of local leadership promotes improved quality care for patients, greater referral volumes and higher occupancy rates. Our operating model is highly transferable to new markets, and enable us to quickly integrate and enhance new facilities.

Transparent and Meritocratic Leadership Culture

We have built a transparent, competitive, and collegial culture that promotes individual growth both personally and professionally and prioritizes a deep commitment to our patients, families, and team members. We promote transparency in performance, which we believe encourages collaboration and healthy competition among local leadership that in turn drives best practices. We believe this meritocratic culture, supported by highly seasoned industry veterans, helps optimize clinical and financial outcomes at facilities and instills accountability throughout

5

the organization. This leadership mindset has empowered us to develop a deep bench of leaders capable of supporting our existing and future facilities.

Employer-of-Choice with Directly Aligned Incentive Model

We believe that we are an employer-of-choice in the post-acute care industry, which enables us to attract and retain highly motivated, entrepreneurial individuals who value operational independence and financial opportunity. This has allowed us to attract enterprising individuals from diverse backgrounds who may not have otherwise considered careers in skilled nursing. Our unique compensation model is designed to align local individual incentives with the long-term clinical quality and operational performance of the facility, which we believe fosters a shared ownership mentality. We believe this directly aligned incentive model has played a critical role in successfully attracting, incentivizing, and retaining our industry veterans.

Robust Suite of Technology-Enabled Services

Our technology focus delivers real-time data access to caregivers and administrators, facilitating delivery of the right care at the right time. Our technology tools enable our local leadership teams to focus on their first priority, providing the highest quality care possible to patients. We believe our suite of technologies helps drive decision-making and enhances operating efficiencies that can improve clinical quality, operational metrics, and the financial performance of our facilities. While other facility administrators may spend considerable time on paperwork and low-value activities, we strive to reduce the administrative burden on our facility administrators so they can walk the halls, personally meet patients, and provide a bespoke, concierge-level customer service experience. We equip our clinicians with industry-leading technology, including point-of-care and digital charting technologies, which streamlines charting and paperwork, so they can spend more time with patients and focus on providing high quality care. We believe our technology and internally developed dashboards help to facilitate better patient care, risk management, regulatory compliance, staffing, and resource allocation. We have designed our technology to be easily integrated into new facilities and allow us to scale quickly and efficiently.

Differentiated, Multi-faceted, and Disciplined Acquisition Playbook

Over the past decade, we have demonstrated the effectiveness of our disciplined, multi-faceted playbook of acquiring and improving underperforming facilities, having successfully acquired and integrated over 260 facilities to date. We believe we have established a reputation as an acquiror-of-choice, which has led to several inbound opportunities, and has helped us build an extensive opportunity pipeline. Our balanced approach to evaluation allows us to selectively pursue opportunities that meet our strategic priorities and criteria and grow in a responsible manner. Through our investment into facilities and our integration process, we are able to transition new underperforming facilities to higher-value short-term transitional care facilities. We believe our success is evidenced by our robust QM Star ratings, occupancy rates, and profitability at our Mature facilities.

Our High-Quality Facilities

We are committed to providing a high-quality experience for all of our patients, which is why we invest in capital improvements and ongoing maintenance to all of our facilities, regardless of whether we lease or own. Our investment into facilities is differentiated from traditional industry operators who we believe are often hesitant to make physical plant investments into facilities and who often seek to extract value through cost-cutting or other limitations on facility resources. Our renovations are intended to improve the look and feel of facilities in order to provide an excellent experience. Our investments into medical beds, vitals monitors, physical therapy equipment, and other improvements allows us to provide services to higher acuity patients. We believe our high-quality facilities lead to sustained referral volumes, more admissions, and high skilled mix at our facilities, ultimately leading to higher occupancy rates and revenue per patient day. We also believe our investment into leased facilities makes us a preferred tenant with our landlords and provides us leverage in negotiating favorable lease terms.

6

Our Size and Scale

We believe our market density in key regions offers strategic advantages, such as brand recognition with referring providers, including hospitals and health systems, and consistency and continuity of referrals of patients. For example, our ability to accommodate a high volume of patients within our markets allows us to accept referrals without turning patients away to competitors, and can also further our reputation as a reliable, go-to provider of care for referring providers. We also believe our size and scale has provided us with the ability to negotiate favorable contracts with managed care and other payor sources, the ability to navigate stringent regulatory compliance obligations and withstand potential reimbursement and regulatory industry dynamics, and the ability to leverage real estate value for liquidity and growth.

Industry Overview and Market Opportunity

The Post-Acute Care Continuum is Essential to the Healthcare Ecosystem

We operate in the post-acute care industry, which is an essential component of the healthcare delivery ecosystem, serving high need, medically fragile patients. Post-acute care encompasses multiple care settings outside of acute care hospitals that are differentiated by the acuity level of patients and the services they require. While services may overlap across each distinct post-acute offering, post-acute rehab or SNFs provide the most comprehensive array of services. Upstream care providers, such as acute care hospitals, generally discharge patients to post-acute facilities where patients can receive key services at lower costs.

SNFs are an Integral and Essential Part of the Post-Acute Care Continuum

SNFs play an essential role in post-acute patient care. SNFs provide higher-acuity skilled nursing care to patients that cannot be adequately treated in community-based care settings, such as assisted living or independent living facilities, and who are no longer appropriate candidates for hospital care. Patients referred to a SNF are typically recovering from surgery or non-critical conditions, such as strokes, joint replacements, and acute infections, and are admitted to a SNF within 30 days of being discharged from a hospital where they spent at least three days as an inpatient. In many instances, patients are treated at SNFs prior to receiving home health nursing care and therapy services. The majority of SNF patients are aged 65 years or older. Despite the wide array of services and variety of needs addressed, MedPAC reports that SNFs are the lowest cost facility-based post-acute healthcare, costing on average $550 per covered day compared to $1,850 and $1,753 per covered day for inpatient rehabilitation facilities and long-term acute care hospitals, respectively. According to CMS MedPAC data, SNFs accounted for approximately 44% of the total post-acute care continuum spend. According to CMS Inpatient Hospital discharge data, in 2022, approximately 22% of Medicare patients over 65 years old were discharged to SNFs, representing more than any other facility type, including inpatient rehabilitation facilities and long-term acute care hospitals (approximately 6%), and more than home health nursing care (21%) or hospice (5%). As reimbursement and coverage continues to shift toward value-based models with greater emphasis on controlling costs, SNFs are integral to post-acute care and will continue to drive high-quality outcomes in low-cost settings. Furthermore, during the COVID-19 pandemic, SNFs were widely utilized to treat medically fragile patients, reinforcing the importance of SNFs to the healthcare ecosystem.

Large, Fragmented Industry Comprised of Mostly Small and Independent Operators

According to the National Center for Health Statistics (NCHS) 2020 National Post-acute and Long-term Care Study, the SNF industry in the United States encompasses approximately 15,000 facilities and serves approximately 1.3 million patients annually. The industry is highly fragmented, with the top 10 operators, each having greater than 100 facilities, representing approximately 11% of total number of SNFs in the United States, according to CMS data as of September 2022, approximately 5,000 smaller and independent operators of less than 100 facilities making up the remainder. According to this data, of the approximately 15,000 facilities, approximately 13,200 facilities have less than 100 beds, and approximately 74% and 26% of SNFs are located in urban and rural areas, respectively. In addition, approximately 72%, 23%, and 6% of SNFs are operated as for-profit, as non-profit, and by the government, respectively, according to such data. We believe this fragmented landscape creates opportunities for

7

larger providers with greater scale to serve patients better and meet regulatory requirements nation-wide by effectively addressing staffing, quality standards, and billing processes. Moreover, many small and independent operators face pressure due to billing requirements, regulations, competition on quality of care and facilities, staffing shortages and competition, and the cessation of COVID-related provider relief funding, which has led them to pursue sales of their facilities or businesses. This provides additional opportunity for well-managed, high-quality operators to grow through acquisitions.

Growing Demand Outpacing Supply of Skilled Nursing Facilities

The demand for healthcare services in the United States has increased in recent years and is expected to continue growing, largely due to a rapidly aging population and an increasing prevalence of chronic conditions. According to the U.S. Census Bureau, the U.S. population aged 65 and older is expected to nearly double from 2020 to 2060 and reach 95 million in 2060, which exceeds the expected increase in the general population during that same period, and comprise one fifth of the total U.S. population in 2030. Moreover, according to the U.S. Census Bureau, the U.S. population aged 85 and older is expected to nearly triple from 2020 to 2060 and reach 19 million in 2060. Additionally, according to an article published in Frontiers in Public Health in 2022, the percentage of people in the United States aged 50 and older with at least one chronic condition is estimated to increase by 99.5% from 2020 to 2050. According to CMS data as of September 2022, approximately 82% of SNF patients were 65 years of age or older.

As demand has increased for SNFs, the number of SNFs has declined in recent years from approximately 15,650 in 2017 to approximately 14,900 in 2023. We believe this is due to a variety of factors, including an inability of many facilities to comply with the industry’s stringent regulatory compliance obligations and with quality standards, rigorous staffing, and billing requirements, as well as a lack of technology and sophistication at small and independent operators. Furthermore, new operators to this highly regulated industry face multiple barriers to entry, including the requirements to obtain a Certificate of Need, complex licensure and regulatory compliance requirements, lack of operating experience, and significant capital requirements. As a result, the addition of new SNFs has not kept pace with the number of SNFs exiting the market, amplifying the need for skilled nursing to serve an aging population.

Favorable Reimbursement Environment

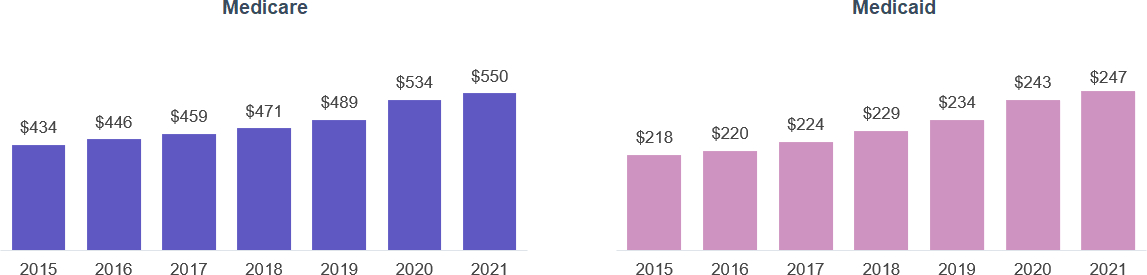

According to CMS, approximately 72% of SNF revenue in 2022 was derived from government sources, including Medicaid and Medicare. Medicaid represents 51% of industry revenue, while Medicare represents approximately 21%. The remainder comprises managed care, private pay, and other payors. Medicare and Medicaid reimbursement has steadily increased over the past few years. Medicare reimbursement per patient day increased at a CAGR of approximately 3.6% from 2012 to 2021, while Medicaid reimbursement per patient day increased at a CAGR of approximately 1.9% from 2012 to 2021. The industry has experienced over 9 years of growth in reimbursement rates.

Regulatory Environment

The SNF industry is highly regulated with stringent regulatory compliance obligations. In the ordinary course of business, providers are subject to federal, state and local laws and regulations relating to, among other things, billing and reimbursement, relationships with vendors, business relationships with physicians and other healthcare providers and facilities, as well as licensure, accreditation, enrollment, quality, adequacy of care, physical plant, life safety, personnel, staffing and operating requirements. Changes in or new interpretations of existing laws and regulations may have a significant impact on revenue, costs and business operations of providers and other industry participants. In addition, governmental and other authorities periodically inspect the SNFs, senior living facilities and outpatient rehabilitation agencies to verify continued compliance with applicable regulations and standards, and may impose citations and other regulatory penalties for regulatory deficiencies. Such regulatory penalties include but are not limited to civil monetary penalties, temporary payment bans, suspension or revocation of a state operating license and loss of certification as a provider in the Medicare or Medicaid program, any of which may be

8

temporary or permanent in nature. This regulatory environment and related enforcement can have an adverse effect on providers and other industry participants.

Our Market Opportunity

Despite the decline in the number of SNFs, the industry is large and growing, with CMS expecting total industry expenditures to increase from $209.3 billion in 2023 to $337.4 billion in 2032, representing CAGR of 5.4%. Based on the number of facilities as reported by CMS, we are one of the largest SNF operators in the United States and believe our scale and other competitive strengths uniquely position us to capitalize on the current underlying trends within the SNF industry and capture a growing portion of this expected growth.

Our Growth Strategies

We have built a multi-faceted growth strategy with multiple organic and inorganic levers to help drive our growth and capitalize on the favorable industry dynamics. To continue our growth, we intend to:

•Expand our presence in existing and new markets. We have a robust pipeline of potential single-facility tuck-in acquisitions, larger multi-facility portfolio acquisitions and select new facility builds across existing and new markets. We have historically completed an average of approximately 20 acquisitions and one de novo, or new-build, facility per year, but have the flexibility to increase or decrease this cadence from period to period in line with our business priorities and as strategic opportunities arise. We plan to continue to strategically pursue opportunities within our pipeline to supplement our organic growth. While we expect to continue to execute on this strategy, we do not have binding agreements or commitments for any material investments at this time.

•Leverage operational upside within our existing footprint. Our portfolio has a healthy foundation for strong embedded organic growth. We are focused on driving higher occupancy and increasing skilled mix in an effort to fill unused capacity with higher acuity patients, which can improve our revenue per patient day and our profitability, which in turn drive growth. Historically, we have found that it takes up to 3 years for a New facility to scale to performance similar to that of a Mature facility. As of June 30, 2024, we had 70 New facilities and 85 Ramping facilities, which we define as facilities purchased within 18 to 36 months prior to the measurement date. We believe these facilities provide us some degree of near-term visibility into expected organic growth within our footprint.

•Continue to grow our pipeline of leaders. Our rapid growth in size and scale can be attributed to our deep bench of talented leaders. Our administrators in training provide us with leadership resources that we can use to quickly staff new facilities with qualified operators. Similarly, our RVPs enable us to scale within regions. We intend to invest heavily in training existing leaders and expanding our bench of new administrators and RVPs to support our future growth.

•Extract embedded value from real estate ownership. We plan to continue to evaluate our real estate purchase options in an effort to reduce our rent burden and grow the underlying earnings of our business. We have executed 18 purchase options since 2013 and had 13 additional options available to us as of June 30, 2024. We intend to continue to selectively exercise purchase options and continue structuring additional purchase options to provide an additional lever to grow net margins and enhance stockholder value. Moreover, we believe that our real estate ownership provides balance sheet support as an inflationary hedge, provides capital flexibility as a source of asset collateral, reduces the burden of leases and restrictive agreements, and allows us the opportunity to create additional value in improving distressed assets.

•Ancillary opportunities. We have identified and continue to evaluate multiple investment opportunities that have the potential to improve our post-acute patient experience by augmenting the services we provide. We may capitalize on these investment opportunities that are ancillary to our core business, such as pharmacy services, laboratory services, transportation, and imaging, which have the potential to be additional sources of revenue and operating income over time. We refer to these efforts to build a strategic mix of investments

9

in ancillary business lines as “PACS Ventures.” We continue to evaluate opportunities to in-source, acquire, and commercialize these ancillary opportunities. Additionally, we may choose to monetize our PACS Services by offering it to third-party SNF operators in the future.

•Expand into other post-acute sites of care. We believe that our proven operational playbook and focus on delivering high-quality care have the potential to be utilized in additional post-acute sites of care, including home health and hospice as well as within broader senior living communities. As of June 30, 2024, we had one independent living facility and five assisted living facilities which provide a foundation for further expansion.

Recent Developments

Initial Public Offering

On April 15, 2024, we closed our initial public offering (IPO), which consisted of 21,428,572 shares of common stock sold by us and 3,214,284 shares of common stock sold by selling stockholders, at a public offering price of $21.00 per share, which resulted in $423.0 million in net proceeds to us. We did not receive any of the proceeds from the sale of shares of common stock by the selling stockholders in the IPO. We used approximately $370.0 million of the net proceeds received by us in the IPO to repay amounts outstanding under our Amended and Restated 2023 Credit Facility, and the remaining amount for general corporate purposes to support the growth of our business.

Recent Acquisitions

On May 22, 2024, we announced the pending acquisition of operations of 53 skilled nursing and assisted living and independent living facilities across eight states, including Oregon (21 facilities), Washington (19 facilities), Idaho (six facilities), Nevada (three facilities), and one facility in each of Alaska, Arizona, California and Montana. The facilities were historically operated by subsidiaries of Prestige Care, Inc., a family company. Collectively, the facilities comprise 2,511 skilled nursing beds and 1,334 assisted living and independent living units. We will lease 37 of the facilities from a joint venture in which we own a 25% interest, and the remaining 16 facilities will be leased from unaffiliated third-party landlords. As of June 30, 2024, we had not finalized the acquisition of any of these operations. Since June 30, 2024, we have finalized the acquisition of operations for 53 of these facilities, representing 2,511 skilled nursing beds and 1,334 assisted living and independent living units.

On July 15, 2024, we finalized the acquisition of operations for 3 skilled nursing facilities. The operations are located in Kansas. Collectively, these facilities comprise 378 skilled nursing beds. These facilities are leased from a third-party landlord, with the option to purchase the facilities from the landlord at a later date.

Summary Risk Factors

There are a number of risks that you should understand before making an investment decision regarding this offering. You should carefully consider all of the information in this prospectus, including risks and uncertainties described in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” before making a decision to invest in our common stock. If any of these risks actually occur, it could have a material adverse effect on our business, financial condition, and results of operations. In such case, the trading price of our common stock would likely decline, and you could lose all or part of your investment. These risks include, but are not limited to:

•We depend upon reimbursement from third‑party payors, and our revenue, financial condition and results of operations could be negatively impacted by any changes in the acuity mix of patients in our facilities as well as changes in payor mix and payment methodologies and new cost containment initiatives by third-party payors;

10

•We may not be fully reimbursed for all services for which each facility bills through consolidated billing or bundled payments, which could have an adverse effect on our revenue, financial condition and results of operations.

•Increased competition for, or a shortage of, nurses, nurse assistants and other skilled personnel could increase our staffing and labor costs and subject us to monetary fines.

•We rely on payments from third-party payors, including Medicare, Medicaid and other governmental healthcare programs and private insurance organizations. If coverage or reimbursement for services are changed, reduced or eliminated, including through cost-containment efforts, spending requirements are changed, data reporting, measurement and evaluation standards are enhanced and changed, our operations, revenue and profitability could be materially and adversely affected.

•Reforms to the U.S. healthcare system, including new regulations under the Affordable Care Act (ACA), continue to impose new requirements upon us that could materially impact our business.

•We are subject to various government and third-party payor reviews, audits and investigations that could adversely affect our business, including an obligation to refund amounts previously paid to us, potential criminal charges, the imposition of fines, and/or the loss of our right to participate in Medicare and Medicaid programs or other third-party payor programs.

•State efforts to regulate or deregulate the healthcare services industry or the construction expansion, or acquisition of healthcare facilities could impair our ability to expand our operations, or could result in increased competition.

•We face numerous risks related to expiration of the COVID‑19 public health emergency (PHE) expiration and surrounding wind down and uncertainty, which could, individually or in the aggregate, have a material adverse effect on our business, financial condition, liquidity, results of operations and prospects.

•If we fail to attract patients and residents and to compete effectively with other healthcare providers, our revenue and profitability may decline and we may incur losses.

•We review and audit the care delivery, recordkeeping and billing processes of our operating subsidiaries. These reviews from time to time detect instances of noncompliance that we attempt to correct, which in some instances requires reduced or repayment of billed amounts or other costs.

•We are subject to litigation, which is commonplace in our industry, which could result in significant legal costs and large settlement amounts or damage awards, and our self-insurance programs may expose us to significant and unexpected costs and losses.

•We rely significantly on information technology, and any failure, inadequacy or interruption of that technology could harm our ability to effectively operate our business.

•We may be unable to complete future facility or business acquisitions at attractive prices or at all, which may adversely affect our revenue; we may also elect to dispose of underperforming or non‑strategic operating subsidiaries, which would decrease our revenue.

•In undertaking acquisitions, we may be adversely impacted by costs, liabilities and regulatory issues that may adversely affect our operations, and we may not be able to successfully integrate acquired facilities and properties into our operations, or achieve the benefits we expect from any of our facility acquisitions.

•Because we lease the majority of our facilities, we are subject to risks associated with leased real property, including risks relating to lease termination, lease extensions and special charges, any of which could have an adverse effect on our business, financial condition and results of operations.

11

•We operate in a highly regulated industry with stringent regulatory compliance obligations, and are subject to extensive and complex laws and government regulations. If we are not operating in compliance with these laws and regulations or if these laws and regulations change, we could be required to make significant expenditures or change our operations in order to bring our facilities and operations into compliance.

•We have broad discretion in how we may use the net proceeds from this offering, and we may not use them effectively. We intend to use all of the net proceeds to us from this offering to repay amounts outstanding under our Amended and Restated 2023 Credit Facility, which will reduce the extent of the net proceeds available for general corporate purposes to support the growth of our business.

•Following this offering, our founders, Jason Murray and Mark Hancock, will collectively own a significant majority of our common stock, representing approximately 73.7% of the voting power of our common stock (or approximately 72.4% if the underwriters exercise their option to purchase additional shares of our common stock from the selling stockholders in full). In addition, pursuant to the terms of our Amended and Restated Charter, our founders are able to control corporate matters for the foreseeable future. For example, each founder has the right to designate (i) up to two individuals for inclusion in our slate of director nominees if such founder beneficially owns at least 20% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO or (ii) one individual for inclusion in our slate of director nominees if such founder beneficially owns less than 20% but at least 10% of the aggregate number of shares of common stock outstanding immediately following the completion of our IPO. Accordingly, each founder has the right to designate two directors, and our founders collectively have the right to designate four directors, which represents four out of our five member board of directors. These rights are affirmed in the Stockholders Agreement. In addition, pursuant to the terms of our Amended and Restated Charter, for so long as our founders beneficially own, in the aggregate, the majority of the voting power of our outstanding shares of voting stock, our founders are able to remove any of our directors at any time with or without cause and may take action by written consent without a meeting of stockholders. Our Amended and Restated Charter authorizes our board of directors to establish and determine, among others, the voting, board representation and other rights or preferences of one or more series of preferred stock, and our board of directors may determine to issue additional shares of common stock, in each case without stockholder approval. This concentrated control, due to both the provisions of the Amended and Restated Charter and Stockholders Agreement and the voting power of our founders, will preclude your ability to influence corporate matters for the foreseeable future, including with respect to the composition of our board of directors, the election and removal of directors, the authorization and issuance of additional shares of our common stock that would be dilutive to you, the issuance of shares of preferred stock that could be dilutive to you and could have disparate voting rights, amendments to our organizational documents, and any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transactions requiring stockholder approval.

•Our founders have entered into margin loans and pledged a portion of their shares of our common stock as collateral to secure such margin loans. If either Mr. Murray or Mr. Hancock default on their respective obligations under any margin loans, the lender may be entitled to foreclose on their shares pledged as collateral and sell them to the public, which could cause our stock price to decline and result in a significant change in beneficial ownership.

•We are a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. As a result, we may elect to rely on exemptions from certain corporate governance standards and you may not have the same protections afforded to stockholders of companies that are subject to such requirements.

•Affiliates of Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Truist Securities, Inc., and RBC Capital Markets, LLC, each an underwriter in this offering, will each receive at least 5% of the net proceeds of this offering and may have an interest in this offering beyond customary underwriting discounts and commissions.

12

Corporate Information

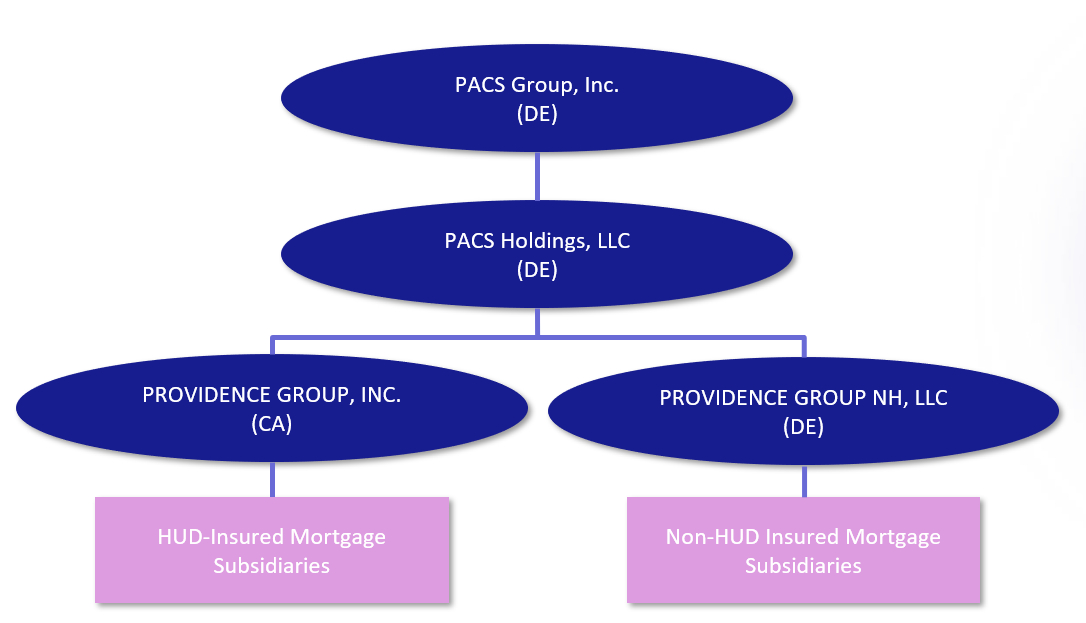

We were initially incorporated on December 17, 2012 as Providence Group, Inc., a California corporation. On June 30, 2023, we undertook a reorganization in connection with our entry into a new credit agreement described in more detail in the section titled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Liquidity & Capital Resources—Credit Facilities.” Pursuant to this reorganization, PACS Group, Inc., which was incorporated on March 24, 2023 as a Delaware corporation, became the parent entity for our organization. The following diagram sets forth a simplified view of our corporate structure as of June 30, 2024. This chart is for illustrative purposes only and does not represent all legal entities affiliated with the entities depicted. The operating subsidiaries that represent our various facilities are omitted.

PACS Group, Inc. is a holding company with operating subsidiaries that provide skilled nursing, senior living, as well as other ancillary businesses. Each facility is structured as an operating subsidiary under one of our two subsidiary holding companies: Providence Group, Inc. and Providence Group NH, LLC. Subsidiaries of Providence Group, Inc. are currently operating subsidiaries (facilities) with mortgage loans insured by the U.S. Department of Housing and Urban Affairs. Subsidiaries of Providence Group NH, LLC are currently operating subsidiaries (facilities) without such mortgage loans.

PACS Group, Inc. and its subsidiaries that are not licensed healthcare providers do not provide healthcare services to patients, residents or any other person, and do not direct or control the provision of services provided. All healthcare services are provided solely by applicable subsidiaries that are licensed healthcare providers, under the direction and control of licensed healthcare professionals in accordance with applicable law.

Our principal executive offices are located at 262 N. University Ave, Farmington, Utah 84025, and our telephone number is (801) 447-9829. Our website address is www.pacs.com. Information contained on, or that can be accessed through, our website is deemed not to be incorporated in this prospectus and does not constitute part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only. Investors should not rely on any such information in deciding whether to purchase our common stock.

13

Status as a Controlled Company

The rules of the New York Stock Exchange define a “controlled company” as a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. Following this offering, our founders will collectively own a significant majority of our common stock, representing approximately 73.7% of the voting power of our common stock (or approximately 72.4% if the underwriters exercise their option to purchase additional shares of our common stock from the selling stockholders in full). We are a “controlled company” under the rules of the New York Stock Exchange. As a result, we qualify for and may elect to rely on exemptions from certain corporate governance requirements under the rules.

If we cease to be a controlled company and our common stock continues to be listed on the New York Stock Exchange, we will be required to take all action necessary to comply with applicable rules. See the sections titled “Management—Director Independence and Controlled Company Exception” and “Risk Factors—We are a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. As a result, we may elect to rely on exemptions from certain corporate governance standards and you may not have the same protections afforded to stockholders of companies that are subject to such requirements.”

14

THE OFFERING

Common stock offered by us |

2,777,778 shares. |

|||||||

Common stock offered by the selling stockholders |

11,111,112 shares. |

|||||||

Underwriters’ option to purchase additional shares of common stock from the selling stockholders |

The selling stockholders have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 2,083,332 additional shares of our common stock. |

|||||||

Common stock to be outstanding after this offering |

155,177,511 shares. |

|||||||

Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $104.8 million, based upon the assumed public offering price of $39.67 per share, which is the last reported sale price of our common stock as reported on the New York Stock Exchange on August 30, 2024 and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use all of the net proceeds to us from this offering to repay amounts outstanding under our Amended and Restated 2023 Credit Facility. We will have broad discretion in the way that we use the net proceeds of this offering. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. See the section titled “Use of Proceeds” for additional information.

|

|||||||

Controlled company |

We are a “controlled company” within the meaning of the corporate governance rules of the New York Stock Exchange. As a “controlled company,” we may elect to rely on exemptions from certain corporate governance standards of the New York Stock Exchange. See the section titled “Management—Director Independence and Controlled Company Exception.”

|

|||||||

| Conflicts of interest |

Because affiliates of Citigroup Global Markets Inc., J.P. Morgan Securities LLC, Truist Securities, Inc. and RBC Capital Markets, LLC are lenders under our Amended and Restated 2023 Credit Facility and will each receive at least 5% of the net proceeds to us from this offering in connection with the repayment of amounts outstanding under our Amended and Restated 2023 Credit Facility, a “conflict of interest” within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (FINRA) is deemed to exist. Accordingly, this offering is being made in compliance with the applicable requirements of FINRA Rule 5121. The appointment of a “qualified independent underwriter” is not necessary for this offering pursuant to FINRA Rule 5121(a)(1)(B) as a “bona fide public market,” as defined in FINRA Rule 5121, exists for our common stock. See the sections titled “Use of Proceeds” and “Underwriting (Conflicts of Interest)” for additional information.

|

|||||||

15

Dividend policy |

We have no current plans to pay dividends or other distributions on our common stock in the foreseeable future. Any decision to declare and pay dividends in the future will be made at the sole discretion of our board of directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our board of directors may deem relevant. See the section titled “Dividend Policy.”

|

|||||||

Risk factors |

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

|||||||

New York Stock Exchange trading symbol |

Our common stock is listed and traded on the New York Stock Exchange under the symbol “PACS.” |

|||||||

The number of shares of our common stock to be outstanding after this offering is based on 152,399,733 shares of our common stock outstanding as of June 30, 2024, and excludes:

•1,580,986 shares of common stock reserved for future issuance under our 2024 Incentive Award Plan (2024 Plan);

•11,561,818 shares of common stock issuable upon vesting of all restricted stock units (RSUs) awarded; and